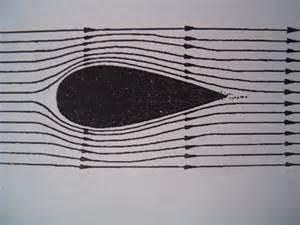

“Streamlined.” Sounds fast. Something that is streamlined even looks fast. Gotta love that streamlining thingy, regardless of the who, what, where, how, and why. Yes sir – in this day and age of motion and speed, one can’t go wrong with anything that is streamlined.

“Foreign” and “Domestic.” Exact opposites. Yet the two most often appear together, like salt and pepper. Especially in government – “… against all enemies, foreign and domestic,” appears in most official oaths of office or positions of government service. Together, they’re all-encompassing; separately, they are most discreet, even in governmental issues.

“Offshore.” Somewhere, out there. Not being here, onshore, it’s a way of locating people, places, and things that are not contained by the natural boundaries formed by the shorelines of seas and oceans. In practical terms, it refers to objects on the “other side” of those shorelines.

“Offshore.” Somewhere, out there. Not being here, onshore, it’s a way of locating people, places, and things that are not contained by the natural boundaries formed by the shorelines of seas and oceans. In practical terms, it refers to objects on the “other side” of those shorelines.

“Procedures.” Methods; ways and means. If there’s a task to be accomplished, these are followed in order to successfully arrive at the desired conclusion in an efficient and timely manner. “Proper” procedures almost always guarantee success, if followed.

Put these four selections together (we’ll let the selection of “domestic” rest peacefully in this article), and you have today’s topic:

STREAMLINED FOREIGN OFFSHORE PROCEDURES

In continuing last week’s article, you dear readers who live outside of the U.S. are going to find that there is an easy way to “become current” with U.S. Income Tax and financial reporting responsibilities. You’ll also find that I won’t throw a lot of tax theory or tax law precedent or other fluff into the article.

The way a taxpayer with delinquent returns become “current” is to turn himself or herself in to the IRS, throwing him/herself on the mercy of the government for their past misdeeds. Period. I know, that sounds pretty drastic and cruel, but it’s really not as bad as it seems.

Of course, the more delinquent returns and reports you have, or the more you not filing them tends away from forgetfulness and closes in on malice and intent, the more difficult will be the process for you to become current. No one said it was easy, but then no one said it was impossible, either.

Of course, the more delinquent returns and reports you have, or the more you not filing them tends away from forgetfulness and closes in on malice and intent, the more difficult will be the process for you to become current. No one said it was easy, but then no one said it was impossible, either.

For those of you who may be thinking, “Well, since there are so many delinquent tax returns in my stack and no one has bothered me about them yet, maybe I can squeeze on by until the statute of limitations runs out,” here’s a surprise: the clock that counts off the time stipulated by the statute of limitations regarding the filing of income tax returns doesn’t start ticking until the tax return is filed. So that stack you have is one that will always be a problem, regardless of any incantations of “statute of limitations” pleas.

For those taxpayers who are not criminally bent when it comes to income taxes – those who didn’t file out of pure intent or malice – there is this easier way to get current. And it goes by the title of this section.

THE NUTS & BOLTS OF IT ALL

I said I wasn’t going to load you down with a lot of legalese and tax mumbo-jumbo, so here’s the deal – plain and simple: the nitty-gritty.

Lets use, for an example, a taxpayer (T) (a taxpayer in name only, not in activity) who lives overseas and hasn’t filed a tax return or required report in, say, 10 years time. (That’s a long time to go without filing tax returns and not being caught.) For some reason unnecessary to the example, T wants to change his errant ways, become current with his tax return and reporting responsibilities, and continue to file his required returns and reports from that day forward.

T has the following delinquent returns: 10 years-worth of income tax returns and 9 years-worth of foreign financial account reports (FBARs). While penalties for missing income tax deadlines can be stiff, they are nowhere near as draconian as those for not filing FBARs if required to do so. So, it’s in T’s best interest to get current and stay current.

T has the following delinquent returns: 10 years-worth of income tax returns and 9 years-worth of foreign financial account reports (FBARs). While penalties for missing income tax deadlines can be stiff, they are nowhere near as draconian as those for not filing FBARs if required to do so. So, it’s in T’s best interest to get current and stay current.

T goes to a tax professional for help (a licensed CPA, Enrolled Agent with the IRS, a tax lawyer, etc.). He explains that he has those delinquent returns and want to become current. He tells the professional that he didn’t intend to skip filing his reports and returns. In fact, he really wanted to but was fearful of what would happen if he did. As often happens, things get put off, and then put off further, then become routine. There’s no hint of negligence nor is there any hint of intent to evade or defraud the tax system.

The tax professional informs him that he is eligible to become current by employing the streamlined foreign offshore procedures – a modified program for “turning oneself in.” By employing these procedures, T will become current upon the acceptance of his application. That application is a simple form, with which T certified that he has:

- Filed the delinquent or amended tax returns, including all required informational returns, for each of the most recent 3 years for which the U.S. tax return due date (as extended) has passed;

- Pay all income taxes plus all interest accrued that are due for each of those three years, computed in those tax returns;

- State that he failed to report income from one or more foreign financial assets during those three years;

- Certify that he meets the non-residency requirements for the Streamlined Foreign Offshore Procedures;

- Further certify that he meets all other eligibility requirements for these procedures;

- Filed the delinquent FBARs for any of the last 6 calendar years that are delinquent;

- Agree to retain all records related to income and assets during the period covered by the delinquent income tax returns until after 3 years from the date of his certification;

- Additionally agree to retain all records related to his foreign financial accounts until 6 years from the date of this certification;

- Certify that his failure to report income, pay tax. and submit returns and reports (including FBARs) was due to non-willful conduct (i.e., conduct that is due to negligence, inadvertence, or mistake or conduct that is the result of a good faith misunderstanding of the requirements of law;

- State that he understands that the IRS could open investigations into fraud or more severe charges that could result in civil and criminal penalties if the IRS receives or discovers evidence of wilfulness, fraud, or criminal conduct; and

- Provide specific reasons for his failure to report all income, pay all tax, and submit all required information returns (including FBARs).

That’s it. All contained on one two-sided form (Form 14653). All T needs to do is everything he is certifying that he has done (filing this form being one of the final steps to be taken), complete the certification form, sign and date it, and file it.

Upon receiving word of its acceptance, T is considered to be “current.” He filed 3 out of 10 delinquent income tax returns – 7 were completely forgiven without question. He only paid tax and interest on the tax – no penalties, no interest on penalties, nothing else – for those three years. Anything he may have otherwise owed is forgiven.

Upon receiving word of its acceptance, T is considered to be “current.” He filed 3 out of 10 delinquent income tax returns – 7 were completely forgiven without question. He only paid tax and interest on the tax – no penalties, no interest on penalties, nothing else – for those three years. Anything he may have otherwise owed is forgiven.

He filed 6 out of 9 FBARs – 3 were completely forgiven. What a deal! It sure beats the other way – going back to the last tax returns and reports you have filed that are in the IRS’ records, and reconstructing every year, computing taxes, interest, penalties, etc.

If you know someone who might benefit from this program, let him or her know and have them get in touch with a tax professional. It’s great not being delinquent. I’m current!

Paul,

Can I look you up when we get to the Philippines next month? I certainly want to start my life abroad on the right foot!

Hi Doug – Why, yes you may! You can leave a note in the comments to one of my articles when you arrive, and I’ll respond with better contact information.

Welcome to Life’s Big Adventure! You’ll love it.

Paul,

With this required Obamacare, I’ve researched that I can claim an exemption from it since I’m a bonafide foreign resident by filing Form 8965 with my tax return. Is this correct. Thanks so much.

Hi PD – Short answer:

A Bonafide Resident of the Philippines and all members of his/her tax household are “deemed” to have 12 full months of Minimum Essential Coverage (meeting the requirements set by the Affordable Care Act). In doing so, he/she does not have to calculate and make a “Shared Responsibility Payment” and is not required to file Form 8965, but is to check the box on line 61 of Form 1040 (line 38 of Form 1040A, or line 11 of Form 1040EZ) to indicate that you and your tax household meet the MEC requirements.

Explanation (Nothing involving taxes is simple):

The word “exemption” isn’t necessarily the right word to use in this case. There are a set number of specific exemptions from the Affordable Care Act (ACA) mandates which are focused on specific groups of people and their particular situation.

What you’re discovering is a “deeming.” 😯

Let me explain: All persons who are considered to be “U.S. Persons,” as defined in the ACA, are required – starting January 2014 – to have 12 full months of health insurance that provides “Minimum Essential Coverage (MEC),” again as defined in the ACA, for each of those months. Otherwise, the person is subject to what we’ll call the health care tax.

If you have MEC for only part of the year, you pay the tax for the months that you didn’t have MEC. If you have 12 months of MEC, then you pay nothing (and check a box on your tax return that says you meet the 12 months of MEC requirement).

Here’s the part where the “deeming” comes in:

U.S. Persons residing outside of the USA may be able to skip the health care tax, etc., provided that they meet one of two tests that show their being outside of the USA. They are the “Bonafide Resident” test and the “Physical Presence” test.

If a U.S. Person passes one or both of these tests, then that person is “deemed” to have 12 full months of MEC, regardless of whether or not that person has any health care insurance, has too much, or has too little. Health care insurance? It doesn’t matter if you’ve been deemed to have 12 full months of MEC by passing either one or both of those tests.

Here are simple descriptions for the tests – there are more requirements, but these will do for providing explanations:

Bonafide Resident Test: A U.S. Person passes this test if:

….1) The person is legally in another country (with a valid visa);

….2) The person has established his/her residency and “tax home” in that country;

….3) The person has been resident in that country for the entire 12 months of a tax year;

….4) The person accepts potential payment of taxes to that country; and

….5) The person does not make a statement to that country that he/she is not a resident of that country.

Physical Presence Test: A U.S. Person passes this test if:

….1) During a 15-month period of time that includes part of a tax year, the person remains outside of the USA for at least 330 days out of 12 consecutive months.

It should be obvious (huh? What you say, Paul?) that the requirements of the “Bonafide Resident” test can’t be met by someone who has just arrived in the Philippines and set up residence on January 1. For the new arrival, the “Physical Presence” test is about the only way available. Expats who have resided here for longer than a year can possibly meet the “Bonafide Resident” test – care must be taken, however, when considering the visa requirements.

A person possessing a “Tourist Visa” and renewing it as much as they can and/or taking the “visa hop” outside of the country in order to reenter with a new tourist visa — SORRY. A Tourist cannot be a resident, by definition in the law. The “tourists” among us must pass the “Physical Presence” test or calculate and pay the health care tax.

As for Form 8965, “Health Coverage Exemptions,” this form must be completed and attached to the income tax return of a U.S. Person who:

….1) Is required to file a U.S. Income Tax Return;

….2) Does not have MEC for the full 12 months of the year;

….3) Has members of his/her “tax household” who do not have MEC for the full 12 months of the year; and

….4) Wants to report or claim a “Coverage Exemption” for him/herself and/or another member of his/her “tax household.”

I know what you’re thinking – you read the form’s instructions and saw the “Bonafide Resident” and “Physical Presence” tests there and, if passed, they led up to a “Coverage Exemption.” What you read in the instructions is true; however, the form was created more for the calculation of the “Shared Responsibility Payment” (aka health care tax) you’d be required to pay for those months in which you and/or the members of your tax household do not have MEC.

For 2014, the IRS has made it a little simpler. If a U.S. Person (taxpayer) and each member of his/her tax household has 12 full months of MEC, they do not have to file Form 8965. All the person needs to do is check the box on line 61 of Form 1040, line 38 of Form 1040A, or line 11 of Form 1040EZ, and leave the “amount” line blank.

One never knows if procedures and/or forms will change for next year: the above only covers 2014.

Paul,

Thanks so much for the explanation. It’s nice to know i don’t have to file the 8965 and can now file electronically. On Question 3 of the Bonafide Resident Test as i understand from the explanation in Pub 54 that you can leave the Resident Country for short periods at a time as long as you maintain your residence in that country. I’m a correct? Thanks again for your help.

Hi again, PD – That’s absolutely correct. The whole concept is maintaining your residency and your “tax home” in a country outside of the USA. Travel is permitted for business or pleasure. All you need to do is maintain your residency.

The definition of residency boils down to being the location where you plan to return if you leave it for some duration of time. So, if you’ve established residency in the Philippines, that means that, though you might travel back to the USA to visit friend and family or perform some business activity, you have the full intention of returning to the Philippines – your place of residence.

Of course, having a place to stay, a visa to remain in the country to live, and have social and professional connections to the location you call your residence all add to the credibility and justifications that the location is indeed your residence.

Hello Paul,

i’ve been searching around looking for help with my taxes and i came across this article and it seems exactly what i need to have done. ITS BEEN YEARS!

So my question would be, would you know of anyone in the Philippines, preferably down south in Mindanao that could help out with US taxes, and help get me “current?” I’ve seen a lot online, not sure they can be trusted or whatever, i’ve tried calling a few, no answer. But of course, it’s tax season!

Thanks in advance Paul.

Mike

Hi Mike – Well, if you would be willing to trust an old Ohio boy who lives in Ilocos Norte for 7 months of the year (the other 5 back in the land of buckeyes) and who provides the exact same services that you’re looking for (along with many other tax & business services), then I’d be more than happy to assist your becoming current with the IRS.

Just send me a private email directly to my business email address ( [email protected] ) if you desire, and I’ll “take a look under the hood” and let you know what needs to be accomplished.

Hello Mike!

I’m trying to take advantage of the Streamlined Foreign Offshore procedure, but I can’t get ahold of form 14653. The PDF will not load and I’ve done everything I can think of (updated Adobe Reader, multiple browsers, Mac & Microsoft computers). Do you know where else I can obtain this form?

Thanks!

Hi H. Hansen – I’ve sent you a copy of the most current Form 14653 (Rev 6-2016) as an attachment to my private email. The file is in “pdf form” format meaning that you can open the file with Adobe Reader, enter your information, save the form to local storage and print the form.

Take care to understand and follow all of the information and instructions for using the Streamline Foreign Offshore Procedures. You can find these at: https://www.irs.gov/individuals/international-taxpayers/u-s-taxpayers-residing-outside-the-united-states .

Good luck.

Hi, Paul!

Have been reading your blog. I also cannot get hold of a ‘usable’ IRS form 14653! I have the latest version of Adobe but the IRS form is unavailable. I can’t seem to use other sources as well.

Could you possible send one I can use as well. I would be much obliged!

Cheers,

Daniel

Hi Daniel – The form is available at the IRS website. Direct your internet browser to the address: http://www.irs.gov/pub/irs-pdf/f14653.pdf and you’ll have it. This version is the most current (6-2016) and it would be the exact same file that I would send to you as an email attachment.

This form is in “PDF Form” format – you can download the form, open it using Adobe Reader or Acrobat, and enter your information directly onto the form. When you’re finished, just print your completed form.

Whenever you need an IRS form, go to the IRS website first, click on the “Forms and Publications” tab, then follow the instructions to obtain the form or the publication you need. Do not trust third-party websites that say they have the form you need. Chances are you’ll either be charged for downloading it or else it will come with a virus installed.

Good luck.