The best laid plans of mice and men ………

I planned to be here every week or so to provide you, dear readers, with another helping of the finest eggs that my mind can scramble. Well, two failures are the result – one obvious and one not.

Obviously, unlike MacArthur, I didn’t return. As I’ve whined before, “Life Happens” and “Life gets in the way.” Oh, I went through all of the motions: setting aside time in my weekly schedule for writing, additionally intense observations of the world around me, etc. ‘Twas all for naught.

Not obvious, and maybe I should keep it that way, I’ve run out of eggs. Frying pan and whisk are at the ready, my mind is suitably well-heated, the mental lard is bubbling, but no eggs. R remembering some advice from long ago that addresses not knowing what to write about, I’ll follow it. I’ll write about what I know.

remembering some advice from long ago that addresses not knowing what to write about, I’ll follow it. I’ll write about what I know.

So, until Life throws another curveball to this batter, I have returned. Hopefully, my stay and my contributions to this fine Web Magazine will be more to everyone’s liking over the upcoming “so many” weeks, months, years, decades, whatever. Right now, I’ll try my best and present an article that is fitting for this time of year. Yes, dear readers, it’s “Tax Time.”

A “MOST OFTEN ASKED” QUESTION

Over the past few months, this question has tied with another (that will be discussed in another article) for the most frequently asked question about U.S. Income Tax by taxpayers living in the Philippines. Like all things “tax,” the answer is not simple. It can be summarized in a single word, however: “Maybe.”

Q: I’m an Expat from the States living in the Philippines. Do I have to file an income tax return?

A: That all depends on your individual circumstances, you may have to file a U.S. Income Tax return, or a Philippine Income Tax return, or both, or neither.

First, let’s look at the U.S. Income Tax filing requirements. Mandatory filing of a tax return with the IRS is determined by three factors:

First, let’s look at the U.S. Income Tax filing requirements. Mandatory filing of a tax return with the IRS is determined by three factors:

- The amount of your “gross income” received during the tax year;

- The filing status that you are eligible to use; and

- Your age.

Simply put, for U.S. Income Tax purposes, “gross income” is the total amount of income (regardless if it’s cash, property, or services) that is received during the tax year from any and all sources worldwide EXCEPT any income that is EXEMPT from income taxation. Note that I did not say income that was “excluded,” “safe-harbored,” or otherwise not counted as “taxable income.” I said, “EXEMPT.) (Did I say, “simply,” too? Well, that’s as simple as it gets. Remember, with all things “tax,”…………)

There are five different filing status options that a U.S. taxpayer might employ:

- SINGLE – no need for explanation there;

- MARRIED FILING JOINTLY (MFJ) – two eligible taxpayers (e.g., spouses) combined their income tax reporting and tax paying into one tax return.

- MARRIED FILING SEPARATELY (MFS) – each taxpayer of the couple (e.g., each of the spouses) file their own individual income tax return, independent of the other.

- HEAD OF HOUSEHOLD (HOH) – a lone taxpayer with qualifying tax dependents, who live with the taxpayer for the 12 months of the tax year, and for whom the taxpayer provides at least 50% of the housing and living expenses; and

- QUALIFYING WIDOW(ER) (QW) – a taxpayer who lost his MFJ partner through death, having filed MFJ for the tax year immediately prior to the year of the death, who has a dependent

child, and who has not remarried. (A QW can file MFJ for the tax year of the death, then file as a QW – more beneficial than filing SINGLE – for each of the followers two tax years in which the QW taxpayer remains unmarried.)

child, and who has not remarried. (A QW can file MFJ for the tax year of the death, then file as a QW – more beneficial than filing SINGLE – for each of the followers two tax years in which the QW taxpayer remains unmarried.)

The difference involved with age is a little simpler. Taxpayers who are 65 years of age and older are treated differently than their younger counterparts. It gets a little complex for MFJ filers, where there are the permutations of a) both taxpayers are 65 or older; b) one of the taxpayers is under 65; or c) both taxpayers are under 65 years of age.

IF IT’S TAX-RELATED, THERE’S A TABLE FOR IT

Taking all of the information gathered – as described above – into consideration, the determination of whether or not a U.S. Income Tax return must be filed comes down to a single focus: Does the  taxpayer(s) “gross income” exceed the mandated return filing threshold obtained from the appropriate tax table?

taxpayer(s) “gross income” exceed the mandated return filing threshold obtained from the appropriate tax table?

The IRS loves tables. They have a table for almost every complex and simple tax issue that can be thought of, and they don’t mind developing an impromptu table for unique issues not covered by established tables. (More tables than a furniture store!)

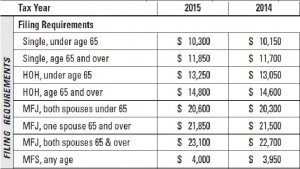

Here is the table we need for the 2014 tax year – yes, they update the tables annually, adjusting some for inflation, some for changes in economic and other environments, and some just to stay busy between tax seasons (personal comment).

There you are. Just determine which filing status line (remember to figure in age) you should be looking at, and check out the amount in the column labeled, “2014.” As you can see, the adjustments for 2015 have already been projected and published.

An example: Both you and your spouse are 65 years old and plan on filing under the MFJ filing status. For 2014, the mandated filing threshold for you is $22,700. If your “gross income” does not exceed $22,700, then you are not legally bound to file a U.S. Income Tax return for tax year 2014.

A final note, there are other instances where filing a U.S. Income Tax return is either mandated or is beneficial to do so voluntarily. If the couple in the example above had any income taxes withheld by the source of their income, they would want to voluntarily file a 2014 U.S. Income Tax return and claim the amount of income taxes withheld as a tax refund. Some of the other mandatory filing instances are:

- A taxpayer who works for tips that may not have been reported to the IRS;

- A taxpayer whose employer failed to withhold income taxes or report income tax withholding;

- A taxpayer who filed an income tax return in the previous year and was subject to the Alternate Minimum Tax (AMT); and

- That’s enough, already!

PHILIPPINE INCOME TAX RETURN FILING

Not being a Philippine Certified Public Accountant, and not holding myself out as a Philippine Certified Public Accountant, I can only pass along a synopsis of the tax laws to you with regard to filing a Philippine Income Tax return. For a non-citizen of the Philippines living in the country, as well as for dual-citizens, the requirements are much simpler. If you earn or receive income within the physical boundaries of the Philippine Islands, you are subject to Philippine Income Taxation on that Philippine-sourced income alone. An income tax treaty between the Philippines and the U.S. allows for this, as well as allowing for income exclusions and tax credits being available to prevent double taxation (being taxed by both the Philippines and the U.S. on the same income).

I recommend that if you are in a situation where you think you might be liable for Philippine Income Taxes, contact a Philippine tax professional for assistance. Trust me: You don’t want to mess with the Philippine Bureau of Revenue (BIR).

There will be more in future articles. For now, I’m really taxed for words. Think I’ll go get an egg salad sandwich.

The scrambled eggs look good

I’ve a good mind for scrambling eggs, don’t you think?

(MindanaoBob so very graciously found and added that picture of scrambled eggs. To Bob go the kudos and, I might add, the complaints of hunger, allergies, and intolerances of all kinds.) 😆

After 12 years of living in the Philippines, my family and I decided to move back to the States. Four years later we have now decided to return to the Philippines. After researching the safest and best place in the Philippines to live Davao City continued to be the trophy winner and always the top choice. I then started researching real estate in Davao City. To my amazement there were several houses on the market In my budget range. More amazing most of them were beautifully furnished. I have purchased and built a number of houses in my life time including 2 in Angeles City, Pampanga. The abundance of so many under valued available furnished houses did not pass the smell test.

My wife of 10 years has matured into another women quite different than the one I married. I liked the original version, but I love the current version much more. She has developed and become more savvy and clever than I would have ever expected or maybe even wanted. I write this about her because she recognized and told me there is no free lunch in Davao City. We need to investigate why so many good deals.

she came into my office today and said she had just read about a terrorist attack 2 hours from Davao City. 44 lives lost and likely more to come. Our airline tickets purchased and many of the arrangements in place we needed to reboot.

I have made my best purchases of real-estate in depressed markets. Davao city certainly falls into that description. For myself after almost 70 years I have little to know fear of adventure and purchasing in a market that will someday recover and do what all depressed markets do. become well, healthy and expensive.

my purpose for writing on this blog was to introduce myself. My other motive was to ask the members to help me convince my wife all the reasons we should move to Davao city. I look forward to reading any posts that will give my wife the confidence to leave the states and move to Davao.

Richard Jay

Richard – When it comes to incidents like that down south, one safely ensconced in Davao City can almost look at that “two hours away” as being “two oceans away.” I’m sure that Bob will attest to the relatively safety of life in the Davao City and the almost polar differences between life there and life “two hours away.”

No need to reboot. Just pack a little bit more “awareness of your ssurroundings” in your bags. You’ll probably need it more to safely navigate traffic than to fend off the “terrorists” in Davao. 😉

When I wrote my comments, there were never any motives or intentions of offending anyone. I certainly hope I did not! At the age of 70 I have resided in many homes. I would like to believe that my next move will only be followed by my final move.

I have been involved in real-estate in one way or another for several years. There are a variety of common elements that usually surface in any market. I am preparing to make a substantial investment in addition to a new place to call home. There are some common and similar conditions present in Davao city real-estate. I have always followed the rule of the known and the unknown. I am limiting my decision based on the known.

I genuinely appreciate your comments. My wife and I after researching life in Davao City have made a conclusion. There is a very safe and obvious favorable quality of life in your fine city.

No offense noted or taken, Richard. “Danger in the PhPhilippines” has always made for great newsprint that sells. With over 7,000 islands to review, one has a very difficult time in trying to equate crimes and horrors to a major city in the U.S.A. The U.S. city always tops these 7,000+ islands by itself. Articles and reports of that, however, are so commonplace that they are often buried a number of pages into the periodical.

Not only are we used to the tranquillity surrounding us, we are used to disclaiming the sensational reporting of incidents outside of the norm.

You’ll discover all of this when you arrive and take up residence, and you’ll be among those of us setting the record straight based – not on a wire service stringer’s imaginative tales but on solid personal experience.

After all, “It’s more fun in the Philippines “! 😉

From hundreds of islands in the world, they chose PALAWAN.

http://philnews.ph/2014/10/21/palawan-top-islands-in-the-world-according-to-conde-nast-travelers-poll/

I wonder why?

No, I am not a real estate agent!

Even the highway is scenic

http://i1237.photobucket.com/albums/ff474/PhilippinoBob/IMG_9859_zpsrqywjaek.jpg

http://i1237.photobucket.com/albums/ff474/PhilippinoBob/IMG_9847_zpsxjucrhah.jpg

http://i1237.photobucket.com/albums/ff474/PhilippinoBob/IMG_9608_zpsajb9zt0c.jpg

http://i1237.photobucket.com/albums/ff474/PhilippinoBob/006_zpsqyvarldd.jpg

I can assure you that Davao City is not a depressed market in the real estate arena. Real Estate is at all time highs here, and not depressed at all. What happens 2 hours away (BTW, Maguindanao is not 2 hours away, it is longer than that) has nothing to do with Davao City. Davao City is, in my opinion, as safe as any other location in the world. I’ve been living in Davao for many years, and I can attest to the safety of the city.

😉

Looking good!

Thanks, Philip. (I’m hoping your talking about me, and not the scrambled eggs.) 😆

Thanks for the informative article Paul. If a USA retiree living in The Philippines having their only source of income from USA Social Security, would they have to pay tax on that ? I think our contributions to Social Security are already a tax. If tax has to be paid again that would be being taxed on a tax !

Hi Bob – For any recipient of USA Social Security anywhere, Social Security benefits may or may not be taxable, depending upon any additional income received by the beneficiary.

To start with, 15% of USA Social Security benefits are exempt from USA income tax, period. That 15% can’t be touched by the taxman.

The remaining 85% of USA Social Security benefits are not subject to USA income taxation so long as a threshold of additional income received isn’t exceeded. (The formula for computing the taxable portion of USA Social Security benefits for a beneficiary with additional income is quite complex.)

So, to match all of this to the scenario you present – a USA retiree living in the Philippines having USA Social Security benefits as the ONLY source of income – all of the USA Social Security benefits received by that USA retiree living in the Philippines would not be subject to USA income taxation.

Additionally, in that scenario, the USA Social Security benefits received as the ONLY source of income would not be considered as part of “gross income: for determining whether or not the USA retiree living in the Philippines would have to file a USA income tax return. He/She would not be required to file a USA income tax return because his/her “gross income” would be $0.00.

Hi Paul –

“The remaining 85% of USA Social Security benefits are not subject to USA income taxation so long as a threshold of additional income received isn’t exceeded. (The formula for computing the taxable portion of USA Social Security benefits for a beneficiary with additional income is quite complex.)”

What is the amount of the threshold of the additional income, or is that the same amount shown in the MFJ tax table for certain ages?

Also, have you heard any good news about the possible elimination of the Social Security Windfall Elimination Provision (WEP)?

Hi John – You’ve found one of the rare issues that is not explained in an IRS table. Determining what portion of Social Security Benefits is taxable is totally calculation-based – no freebie gifts of wisdom from a table! 😆

The calculation for the taxable portion of Social Security benefits resides in another one of the IRS’ most favorite media – the Worksheet. In this case, the worksheet covers most, if not all, of a page in the Social Security instruction booklet.

Sorry – haven’t heard anything regarding elimination of the WEP.

Hi Paul, I read an article from Bob at Expat Island about FATCA recently. It was concerning, and while Bob was generally referring to what seemed like typical bank savings accounts, I am more concerned with investment accounts that provide distributions for income. It’s one thing if a bank makes you move a large savings account where you are making withdrawals to live to another bank, but its quite another thing if an investment firm makes you liquidate long term investments that not only would cause massive capital gains (and taxes) but also eliminate the 4%-6% income generated from that capital.

Seems like this law was passed in 2010, but only started taking effect in 2014. What is a longer term strategy here to safeguard against this? I don’t plan to move for several years so I am still building that capital, but I don’t want to go down a round that later might cause issues.

It seems like away to get around this would be just to use a relatives US address? Have them forward the dividend?

I continue to research this but info (especially options and strategies) is thin. I look forward to your response and ore of Bob’s articles on the matter. It seems like a very dangerous thing coming down the pike for expats.

Hi Mike – You’ve stumbled upon one of the larger but little known facets of bureaucracy created by FATCA. The act itself is so immense and far-reaching that we finally see “SOME” of its implementation years after being signed into law. Like most legislation these days, “good intentions” almost always result in hardships for the honest citizen.

Your observation is extremely correct. Many brokerage houses in the U.S.A. are now terminating the bbrokerage accounts of customers who have moved overseas. The larger and more well-known brokerages are particularly guilty of this indecency, and there is no concern shown for any overseas account holder, regardless of the number of years they’ve traded with those houses.

The biggest evil involved in all of it is the brokerage closing the account and sending a check to the former customer, providing all of the investments (less service fees and charges, of course). The evil becomes visible at tax time. The brokerage dutifully sends you AND THE IRS the various 1099 forms, reporting their actions as a normal “withdrawal” transaction.

If the value of your investments remained the same over the duration that the broker was servicing them, then it’s just the minor evil of reporting it all on a couple of schedules and forms in your income tax return. Well, most customers didn’t invest just to break even, and the markets made sure that they didn’t. Appreciation of the investments, which over the long-term is generally the case, now – with that “withdrawal,” results in realized capital gains. Unless the investments were all in tax-free instruments (such as municipal bonds), there will be unexpected and unplanned capital gains being recognized at tax time, and the associated capital gains tax to pay. Like a bad dream, one’s nest egg is robbed by the taxman because the former brokerage account holder moved to greener pastures.

As you hit on, some overseas investors look to the generosity of a relative or close friend, asking them to extend their kindness by allowing their U.S. mailing address to receive the overseas investor’s correspondence, etc., from the brokerage. It sounds like a workable plan, but it’s not that legal. Not only is the overseas investor in legal jeopardy for fraudulently providing an address not his or her own, but also entangles the beneficent relative or friend in federal fraud charges as well. If more than two persons are involved in the “conspiracy,” the Feds can invoke the RICO statutes as well.

In short — don’t do it, unless you’re willing to take the risks and resulting consequences.

A better way may be to move your investment to a U.S. brokerage account with another firm that serves overseas and foreign investors. You don’t want to move money to a foreign brokerage account – too many problems await the unwise investor doing that. (I’ve already written quite a bit here. Take the size of my response to the power of 10 and you’ll know how much room I’d need to list those problems out.)

Search around and find the brokerage houses that serve the expatriate and foreign investor market, and trust your investments to them. They have the experience in dealing with the issues and with FATCA compliance that the U.S. banks and the timid brokerages are trying hard to avoid. They provide all of the same services that the timid brokerage houses provide, plus they are well-versed in your situation and the needs you’ll have while living overseas.

I cannot make any recommendations or endorsements in this venue, but I will guarantee that the brokerages you seek are out there, waiting for your inquiry.

Good luck, and don’t let anyone get you down.

Good general advice Paul, but readers should be well aware that your posting is US-centric. The readers country of citizenship makes the rules for you, so if you’re not a US citizen then best check the legalities that apply to *YOU*.

Hi Ed –

What if I told you that a citizen of a non-US country, say, the Philippines, who has received income that is US sourced, has income tax responsibilities to the US?

What if I told you that a PH/US dual citizen has just as many income tax responsibilities to the US as any other US Joe?

The “good general advice” applies to more of the readership than you think. In countries that have established treaties with other countries (say, for instance, an income tax treaty) BOTH countries make the rules for the residents of each country, not just the citizenry.

The article was written with the focus being on a timely topic that affects the majority of the readership, making it LiP-centric.

Methinks the horse too tall.

Hi Paul –

I already received the CSA form 1099R from the OPM, and I am ready to file our income tax. However, I am still waiting for the state of Virginia W-2 form or similar to arrive in the mail.

For the life of me, Paul, all these years I have been filing our income taxes, I can’t remember if the state of Virginia issues W-2 foms or similar. I can see on the form 1099R how much VA state tax was withheld, but am I waiting for something that will never come?

Hi John – You may very well be waiting for something that will never come. Rules of thumb:

– Form W-2 is provided by employers and report “earned” income;

– Form 1099(-x) is provided by payers of “unearned” income.

States don’t issue these forms to taxpayers unless the taxpayer is an employee or investor of the state.

The VA withholding amounts on the Form 1099-R is almost all you need.

Hi Paul –

Thank you very much for clarifying this. I have been wracking my mind trying to remember if there is a separate state of Virginia reporting of income form. I just can’t remember. Thank you for confirming there isn’t one, Paul.