Well, it’s definitely a new year, this thing called 2014, and the cycle of life makes another revolution. It’s one month completed all ready, too. Time is starting to zip by again and has brought us to another episode of “Tell the Government how much money you received last year and how much of it are you going to send in.” Yes, tax time is upon us once again.

I can tell it’s tax time just by looking at my inbox. There, among notes from friends and acquaintances, are articles from  various professional groups, advertisements for tax-oriented seminars; and more importantly, e-mail from many locations bearing gifts of questions and problems. Oh yes, it’s tax season all right!

various professional groups, advertisements for tax-oriented seminars; and more importantly, e-mail from many locations bearing gifts of questions and problems. Oh yes, it’s tax season all right!

At this time of year, I usually write a few articles about the income tax that “U.S. Persons” face each year. This year, with inbox already overflowing, will be no exception. I have the questions stacked and ready to go. I’ve answered each individually and, as in years past, many are close enough in subject so that I can compose a question and answer that are fit to print.

So, without further delay, here we go on this year’s adventure.

TAX TIME Q&A, 2014 STYLE

Our first question of the year appears in many forms. It’s a valid question, and deals with a common misconception that’s rampant in the ex-pat community.

Q. I calculated my own taxes on the newest form available from the IRS website, and I don’t have any taxes due. Since I’m not getting a refund, I don’t have to file a tax return this year, right?

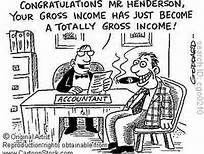

A. Even though you don’t owe any tax and are not getting a refund, you may still be required to file a tax return. I know that sounds strange, but stranger things lurk in the Internal Revenue Code (IRC). Filing an income tax return doesn’t depend on  not owing taxes. The requirement to file a return is based on your gross income. That’s not taxable income (TI) nor adjusted gross income (AGI) but your gross income prior to adjustments.

not owing taxes. The requirement to file a return is based on your gross income. That’s not taxable income (TI) nor adjusted gross income (AGI) but your gross income prior to adjustments.

It is often possible to have deductions, exemptions and credits cancel out any taxable income and/or tax liability, yet still exceed the filing threshold in gross income.

Now, here’s where the nightmare begins. Your gross income has to be calculated “on the side,” and doesn’t really appear on your tax return. Rules for calculating gross income are provided in the tax form’s instructions and they’re pretty straightforward. Just follow the instructions and you’ll do all right. While it’s not rocket science, it’s the closest thing that comes to it that’s done with pencil and paper. If you exceed the threshold, then do yourself a favor and file that return.

= + = + = + =

Q. Since my gross income won’t appear on the tax return, why file one if no tax is due? Who would know?

A. There’s an extremely good chance that the IRS would know. Whenever you receive income from a financial transaction, the party paying you would most likely have filed a tax report informing the IRS of the transaction and its details. Details, like, how much they paid you. The IRS collects this information all year and their computers busily compile it all, building a tax account with your name and your financial dealings in it.

Payers have thresholds they must comply with, with each different type of transaction having its own threshold. For an example, any interest paid by your bank to you that exceeds $10 must be reported by that bank to the IRS on Form 1099-INT. At the beginning of the year, your bank sends you a copy of an aggregate Form 1099-INT for your tax reporting. A payment received from a business over $400 will get you a Form 1099-MISC. Win big at the casino? A Form W-2G will accompany those Benjamins.

Payers have thresholds they must comply with, with each different type of transaction having its own threshold. For an example, any interest paid by your bank to you that exceeds $10 must be reported by that bank to the IRS on Form 1099-INT. At the beginning of the year, your bank sends you a copy of an aggregate Form 1099-INT for your tax reporting. A payment received from a business over $400 will get you a Form 1099-MISC. Win big at the casino? A Form W-2G will accompany those Benjamins.

Another nice thing that the IRS computers do is calculate your tax based on all of the information they’ve collected during the year. If the return you file doesn’t match their calculations within a certain tolerance, you’ll receive a notice from the IRS and a bill for what they say is the balance due. If the IRS is wrong, you have to prove it.

= + = + = + =

THIS WEEK’S SUMMARY

If there is anything that you should take away from the material in this article, it is this:

Don’t fool yourself – Honestly determine whether or not you are legally required to file an income tax return and, if you are, file the most accurate and complete return that you can.

You’ll find this advice as the best you will receive this year. Believe me when I tell you that you really do not want to get involved in an IRS action caused by your failure to file a complete and accurate return. Those of my clients whom I’ve extricated from such activity will readily and wholeheartedly agree. It’s not worth it.

I am actually learning a whole lot more then I want to about taxes this year. I got volun-told to work at our on base tax center. I don’t mind helping with the ones that need it but I don’t mind turning people away that are out of scope either. It is definitely a learning experience being a tax volun-told for VITA.

Hi Gary – Yes, having been involved with the VITA program while in the military, when back in school after retirement, and early on during my accounting career, I found that there were far too many people who were beyond the scope of the program trying to leech off of it. Imagine the anger of the six-figure income taxpayer being turned away at the VITA center (he was also turned away at the AARP center).

It all comes down to personal ethics on both the taxpayer’s side and on the VITA volunteer’s side. The VITA program has its parameters. Part of the VITA volunteer’s job is to make sure that the taxpayers know of those parameters, and use sound, ethical judgment in turning down high-income requests for assistance favor of spending the time with a low-income taxpayer.

Besides, those high-income taxpayers should be coming to me! 😆

Great advice, even tho My VA disability doesn’t count and I don’t pay tax. I have 7% deducted from my SS. Which I get back at filing. Like forced savings. If I have to file, at least I can lookj forward to something.

Hi Philip – “Forced savings” is sometimes the only way many of us can set a few dollars on the side.

Still, I look at it as an “interest free loan” to Uncle Sam, and try to arrange my withholdings and estimated tax payments to provide the dear uncle as little of my hard-earned cash as legally possible. Come tax time, I either come out at a “wash” (no tax due but no refund either) or at a small tax liability. That takes planning and monthly monitoring. Any additional money I would have sent in and received as a refund later I send to an investment account and earn some interest for myself.

I must admit, though, for most of my life I, too, relied on “forced savings” vie the IRS! 😉

Paul,

Where would you recommend an American living in Batangas go to get his go to get his income taxes done properly? Not ex military.

Regards,

Dennis Glass

Hi Dennis – That depends on the complexity of the tax return that needs to be filed.

* If it is an easy, simple return, I usually recommend venturing into DIY (do it yourself) territory, using on-line income tax websites like TaxACT.com. The program there has a good interactive interview, and helps you prepare your own return quite nicely. Support is available, too, if need be. E-filing a federal return via that website is free. E-filing a state return costs a little.

* If it is a difficult, complex return, or even a not-so-complex but hard or confusing, I’d recommend a tax professional. I try to stay away from tooting my own horn, but you can check me our at http://www.k-c-limited.com. I’d gladly help you out.

Of course, wherever you look and whomever you look at, remember “Caveat Emptor” (Let the buyer beware.)

Good luck, and happy filing.

Hi Paul ….I think many US expats are thinking about IRS tax reporting. Since I lived in the USA most of last year I have Federal and State taxes to file even though I no longer live there (USA). I have seen what our wonderful Gov. can do if they want to ……so I for one am always going to file a tax return….I have always used a “commercial off the shelf “software tax program and it has always worked great for me. My returns are complicated by Limited Partnerships (k-1s) and other tax advantage Stocks but the software works great. no complaints.

Hi Dave – I agree that “COTS” tax software is getting better and better. This year might be a test, though, with tax law changes and new forms, etc. I’m looking forward to the adventure! 😉

You’re a little lucky in the complexity department – you could have CFCs and PFICs to deal with! 😯

Good luck with your filing this year. New Net Investment Income Tax (via new Form 8960) will be an experience we can share over an SMB! 😆

Great Post. I just want to share a good source for tax forms and tutorials – PDFfiller. It has a ton of tax and insurance forms. It helps me fill out a needed form neatly and gives me the option to esign. http://www.pdffiller.com/en/categories_search

Hi Ray – Thanks for sharing the information with the readers.

PDFfiller.com is a good source for those seeking forms, and it’s a source in my library. I’ll sometimes go to it to find a “special” form that’s not readily available in my tax software, or has been updated but the associated tax agency’s website is either down or “unfriendly”! 😉