We’re sure in the depths of tax season – deep in the season. Yet, most of my “work” is taking place on the telephone and not at the computer keyboard. Client tax information is only trickling in this year, with most looking to take advantage of the overseas automatic two-month extension of time to file their tax returns.

No, most of my work for the past few days has been answering the phone, answering the questions, and doing a lot of informal training and explaining to clients, soon-to-be clients, former clients looking for a graceful way to rejoin the client list, and even you, dear readers.

I don’t mind it one bit. The gift of gab (and of Blarney – belated Happy St. Patrick’s Day) is one (or two) that I don’t mind sharing. Make the topic tax-related, and overdrive, here we come. But the topic of choice these past few days has been near unanimous. I’m talking about F.A.T.C.A.

F.A.T.C.A – What It Is

The Foreign Account Tax Compliance Act, better known as F.A.T.C.A. – or for this article “FATCA” to speed up my keyboard poking a little bit – is the child of the 2010 Hiring Incentives to Restore  Employment – or “HIRE” – Act. Unlike its parent’s name, however, it’s proving to be more of a “disincentive” than any form of incentive that could possibly be related to restoring employment.

Employment – or “HIRE” – Act. Unlike its parent’s name, however, it’s proving to be more of a “disincentive” than any form of incentive that could possibly be related to restoring employment.

This two-pronged sword of economic justice has certain financial accounts and assets that are held in financial institutions outside of the United States as it’s reason for being. I say two-pronged because it’s wielded against the U.S. taxpayer and against the financial institutions outside of the U.S. that have U.S. taxpayers as customers. Both victims are prodded into compliance with the non-compliant being the target for draconian thrusts and slashes of its terribly sharp, uncaring blades.

All it really is can be simply called administrative reporting, for the most part, with a little tax implication for those who hold massive wealth outside of the U.S. and don’t report any of the income generated by that wealth in the form of interest, dividends, and royalties. That’s all. The “disincentive” comes into play with the various, uncoordinated processes around the world to implement it.

FATCA – The Problem

The problem with FATCA – the one that is giving your humble scribe cauliflower ear and hoarse voice – is its widespread misinterpretation and resulting error prone implementation around the world. Plagued with swarms of complaints, the Treasury Department has started to issue letter containing the proper forms and instructions to U.S. taxpayers known to reside outside of the United States. Still, Joe, Jane, Juan, and Precious Q. Taxpayer are confused, perplexed, and at their wits’ ends trying to comply.

Though signed into law some 5 years ago, it is only now being implemented in earnest. The reason for the delay can be found in both a desire by the Treasury Department and the IRS to avoid the snarled catastrophe that happened anyway with regard to a simple, easy implementation; and in those same departments and agencies not being prepared themselves to receive and process all of the Tetra-TerraBytes of information that they will be receiving annually for years to come from sources all across the globe.

Though signed into law some 5 years ago, it is only now being implemented in earnest. The reason for the delay can be found in both a desire by the Treasury Department and the IRS to avoid the snarled catastrophe that happened anyway with regard to a simple, easy implementation; and in those same departments and agencies not being prepared themselves to receive and process all of the Tetra-TerraBytes of information that they will be receiving annually for years to come from sources all across the globe.

The result? One living overseas can see it up close and personal whenever they visit their neighborhood bank. The Philippines is no exception. Each bank appears to have their own locally generated ideas of what the requirements are, who has what requirement to meet, and how the requirements are to be met. Thus, for the fellow on the other end of the finger madly poking away at the virtual keyboard of his tablet, the telephone calls come. The names and locations are different, but the reason for the calls is the same for each bending of the ear. The taxpayers are seeking sanity in an insane situation.

FATCA – What Is Required

For U.S. taxpayers who have a Social Security Number as their U.S. Tax Identification Number (TIN), the requirement placed on them (as far as interactions with their “foreign financial institution” goes) is simply to provide their foreign financial institutions with their TIN. This is accomplished by completing and signing an IRS Form W-9, and delivering that form to their foreign financial institutions. Simple, huh?

For U.S. taxpayers who have a Social Security Number as their U.S. Tax Identification Number (TIN), the requirement placed on them (as far as interactions with their “foreign financial institution” goes) is simply to provide their foreign financial institutions with their TIN. This is accomplished by completing and signing an IRS Form W-9, and delivering that form to their foreign financial institutions. Simple, huh?

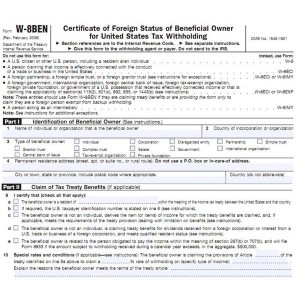

For U.S. taxpayers who have an IRS provided Individual Tax Identification Number (ITIN) as their U.S. TIN, and for others who do not have a U.S. TIN at all, the requirement placed on them is simply to provide their foreign financial institutions with their TIN, as well. They, however, accomplish this by completing and signing an IRS Form W-8BEN, and delivering that form to their foreign financial institutions. See the difference? Huh? See it?

For U.S. taxpayers who have an IRS provided Individual Tax Identification Number (ITIN) as their U.S. TIN, and for others who do not have a U.S. TIN at all, the requirement placed on them is simply to provide their foreign financial institutions with their TIN, as well. They, however, accomplish this by completing and signing an IRS Form W-8BEN, and delivering that form to their foreign financial institutions. See the difference? Huh? See it?

I’m sure that all of you, dear readers, see the difference. Why is it that all of these financial institutions – the people you entrust with your hard-earned savings and other funds – cannot see it? Not only the small difference, they appear blind to the entire requirement.

Horror stories of numerous forms and IDs, and go here and go there, and even one instruction to have everything notarized — they abound. Additionally, there are the threats of dire consequences if the procedures aren’t followed to the letter, and if that letter is a “T” or an “I,” it better be crossed or dotted.

Most often, the threat involves the immediate closing of the account, freezing its contents until after they’ve been officially audited and certified, and then a “clearance” period of “X” number of business days (holidays, official or otherwise do not count) before the funds can be released to the owner of the closed account. “You are the owner, sir, are you not?”

FATCA – In Closing

Yes, you are between a rock and a hard place, and yes it’s the rock you’ll find yourself having to deal with. My advice, however, is just as simple as those requirements that I presented. “Don’t worry, be happy.” Fully complete and sign your appropriate form and, with a smile on your face and a pleasant attitude being emitted from every pore of your body, deliver your form to your financial institution of choice, thank them for their service, and try very daintily to slip away.

Yes, you are between a rock and a hard place, and yes it’s the rock you’ll find yourself having to deal with. My advice, however, is just as simple as those requirements that I presented. “Don’t worry, be happy.” Fully complete and sign your appropriate form and, with a smile on your face and a pleasant attitude being emitted from every pore of your body, deliver your form to your financial institution of choice, thank them for their service, and try very daintily to slip away.

If you encounter any difficulties with the staff, keep smiling while you firmly ask to speak with the branch or office manager. Don’t settle for an assistant – you want to speak with the real deal. When you do speak with the manager, let the manager know – through your smiling and pleasant demeanor – that you have fully complied with the requirements of FATCA, and that the financial institution will not be mandated by the IRS to withhold 30% of your interest income from your account, wire the withholding to the IRS, and file the additional report of noncompliance associated with that withholding. All because you have complied in full with FATCA.

If you encounter any difficulties with the staff, keep smiling while you firmly ask to speak with the branch or office manager. Don’t settle for an assistant – you want to speak with the real deal. When you do speak with the manager, let the manager know – through your smiling and pleasant demeanor – that you have fully complied with the requirements of FATCA, and that the financial institution will not be mandated by the IRS to withhold 30% of your interest income from your account, wire the withholding to the IRS, and file the additional report of noncompliance associated with that withholding. All because you have complied in full with FATCA.

(I was going to provide a pleasant travelogue for this week’s article, but …… you know, it’s tax season.)

Thank you for your clear and helpful article!

Hi Byron – You’re most welcome. I do hope it helps.

Good article!

Thanks, Byron.

Wow leave it to the US Govt to screw with you anywhere you go in the world. I guess this will be another hoop to jump through when me and my asawa move to the Philippines this summer. Thanks for the article on this topic it really helps make this clear.

Hi Scott – There have been numerous hoops over the course of time. This one is unique as it has a U.S. federal agency making demands on foreign financial institutions on foreign soil for the first time ever. What audacity! Plus the leveraged threat of diminished abilities to interact with U.S. banks being the consequence for non–compliance.

In addition if you are a U.S. citizen and have a foreign currency account e.g. a dollar account in a Phl bank the Phl bank will ask you to sign a document that allows them to release information on you and your foreign currency account. This is to get around the Phl law on secrecy of foreign currency accounts.

Hi Suzukig – From many reports that the U.S. Treasury Department is receiving, foreign banks and other financial institutions are using their compliance with FATCA as reason to obtain any number of items of information from customers. The Philippines is no exception. Different bank = different requirement.

One of the larger banks in the Philippines (that will remain nameless for this article and its comments) is requiring U.S. citizen customers to complete a multi-paged questionnaire that delves into the customer’s personal financial circumstances to include whether the customer rents or owns his/her dwelling, how many automobiles the customer owns and if they’re registered, and other items that are not related to FATCA.

There is a label for such activity: data mining. With the answers to the questions asked, the bank can tailor the sales of its financial products and services to the customer in order to enhance the probably of a sale. It’s a legal marketing schema, but it is being applied unethically.

http://www.lawphil.net/statutes/repacts/ra1974/ra_6426_1974.html

REPUBLIC ACT No. 6426

AN ACT INSTITUTING A FOREIGN CURRENCY DEPOSIT SYSTEM IN THE PHILIPPINES, AND FOR OTHER PURPOSES.

Section 8. Secrecy of foreign currency deposits. – All foreign currency deposits authorized under this Act, as amended by PD No. 1035, as well as foreign currency deposits authorized under PD No. 1034, are hereby declared as and considered of an absolutely confidential nature and, except upon the written permission of the depositor, in no instance shall foreign currency deposits be examined, inquired or looked into by any person, government official, bureau or office whether judicial or administrative or legislative, or any other entity whether public or private;…

Hi Suzukig – Yes, the Philippines has the RA with the secrecy clause, just as many other countries do. While the Philippines has yet to sign an Intergovernmental Agreement (IGA) concerning FATCA, they are leaning toward it.

The Central Bank of the Philippines has directed banks that may fall under the claws of FATCA to set up methods for becoming compliant with FATCA, yet keeping RA 6426 and other acts in mind while doing so. This act is one of the sticking points in the negotiations.

For 2014 and 2015, the Philippines is “considered to have” an IGA (model 1) regarding FATCA – that only keeps financial institutions trying to meet compliance requirements from being penalized for not being compliant yet.

My point, however, is best demonstrated by the Central Bank’s direction – having everyone make their own policy that not only brings about FATCA compliance, but doesn’t violate the laws of the Republic. Thus, different bank = different requirements; all in the name of following the Central Bank’s direction. Had the Central Bank taken time to investigate this situation (they’ve had since 2011 to do so), they could have developed a singular policy for all banks to follow. That would eliminate confusion among the banks, symmetry in the banking world.

Paul,

Ok so I am retiring soon.. My wife is NOT a US Citizen, but was issued a SSN when she arrived in the US. She has no intention of working in the states and no intention of becoming a US citizen. When we retire to the Philippines, I will recieve my pension. Should my wife decide to work at that time, how would that work for us as far a filing taxes and such.. Since she is not a US citizen and would be working in her native country, does she still have to pay tax to US? How do we avoid her paying tax, how would we file our taxes? Jointly? Seperately? does she have to file at all? Does she lose her SSN when her green card expires? We really only intend for my pension to be used for US taxes…. If she works she would be paying RP taxes and we dont want her income used with mine or have any tax liability to the US.

Hi Chris – Since your wife is a U.S. Resident Alien (i.e., a “green card holder’), she is considered to be a “U.S. Person” for U.S. Income Tax purposes, similar to U.S. citizens. Simply put, both you and your wife are U.S. taxpayers – subject to the same rules, regulations, and obligations when it comes to U.S. Income Tax.

As long as she holds that status, she will have to report and pay income taxes on all income that she receives from any source worldwide that is not exempt from U.S. income taxation. (Just like you.)

If she maintains that status and you both retire to the Philippines, and she then decides to go back to work, then the income she earns in the Philippines will be subject to reporting for both Philippine and U.S. Income Tax purposes, and may be taxed by both countries as well.

The operative word there is “may” – not must and not will. The Philippines and the U.S. have an income tax treaty in force that has provisions within it that a particularly aimed at preventing the “double taxation” of the same income of a taxpayer. Among the provisions:

— The Foreign Tax Credit: whereby the taxpayer is entitled to a dollar-for-dollar (or peso-for-peso) credit equal in amount to the income tax paid to the country in which the income was received that can be applied against the income tax being assessed by the other treaty country.

— The Foreign Earned Income Exclusion, whereby a U.S. taxpayer receiving “earned income” (salary, wages, compensation for labor or services provided, etc.) in another country may exclude up to a specific amount of that income from gross income, thereby reducing taxable income and its resulting tax liability. The 2014 limit is $99,200; 2015 will be $100,800.

— There are other provision that prevent double-taxation via indirect means, such as sourcing the income to a particular treaty country so that only that country can tax the income; and a number more.

Though you generally will have to report the receipt of income in the Philippines by filing a U.S. income tax return, the chances of you paying income tax on that income is extremely slight.

When it comes to surrendering the green card, the person giving up permanent U.S. residence is subject to the same expatriation tax obligations as a U.S. citizen renouncing U.S. citizenship. (Now, that can get financially ugly.)

As to Social Security Numbers, the connection with income taxes is purely on of identification. The SSN’s purpose is to identify the Social Security account of a person who is eligible to participate in and receive benefits from Social Security. If your wife has 40 quarters (120 complete months or 10 years) of employment for which time Social Security, Medicare, and FUTA taxes were paid, then she becomes a beneficiary of the Social Security retirement program and would retain her SSN. If she “doesn’t have the 40 quarters,” then her Social Security account is closed, and her number withdrawn and discarded, never to be issued again.

Now the above loss of the SS account and number doesn’t guarantee that she no longer has to pay U.S. income tax. Nonresident U.S. aliens who receive income that is effectively connected to a U.S. business or trade (e.g., interest from a U.S. bank or dividends from a U.S. corporation) must report and pay U.S. income tax on that income (via Form 1040-NR).

Summing up: Don’t worry too much about it. The US-RP Income Tax Treaty will keep you from paying taxes on the same dollar to both the U.S. and the Philippines.

Great Article. How about a article on the FBAR that also has do be done if you have over 10K in a Bank In Phil

Paul has written about FBAR a number of times already, Neal. Perhaps you missed those articles?

Just read it now vintage: April 30 2013

Hi Neal & Bob – I will be reviewing my previous articles on the FBAR to see if they are still “current” or whether any changes that have occurred since they were penned need to be provided.

Thanks again, Paul! You’re the best!

And as always, Elsie, you are the kindest! Thank you for your encouraging words.

Hi Paul,

I don’t see a Tin number on this past year’s W2 form.. Can I just provide my social security number? The BDO form that came in the mail here only requires a Tin number for compliance.

Thanks, Queenie

Hi Queenie – For U.S. citizens and U.S. Resident Aliens (green card holders), the Social Security Number (SSN) serves as their Tax Identification Number (TIN). So, yes: SSN=TIN.

Make sure that the form you submit to BDO is Form W-9. Sometimes the banks will provide Form W-8BEN in its place or provide it with the Form W-9. Form W-8BEN is submitted by U.S. Nonresident Aliens (everybody that doesn’t have an SSN) who either will provide an IRS issued Individual Tax Identification Number (ITIN) or provide their tax registration number from their home country’s government.

Hi again Paul,

Thanks so much for the quick and clear answer. As usual you’re a wealth of tax knowledge, and you’re so generous in sharing it. These issues are something many of us have to learn about and deal with, and they’re not always so clear to the average person.

Queenie

Hi, Im planning on opening UITF fund account in one of the banks in the philippines. My question is if I choose to not use any indicia that I am a US resident is there a good chance that IRS will find out? Also, If I keep my bank balance below threshold will IRS find out? I know this sounds risky but..

Thanks,

Morph

Hi Morph — As I often say, “When it comes to ‘tax questions,’ there are no simple answers.” Once again, that statement rings true. To provide you with a complete answer, I’ll need to break your question into parts, answer each part, then knit all of the answers together into the simplest, easiest to read and understand reply.

1) “…a US resident….”: Are you subject to reporting requirements under FATCA and/or any other government programs?

—- If you are a US resident – meaning that you possess a valid immigrant visa (aka “Green Card”) – you are liable for filing US income tax returns and paying any related income tax. using your Social Security number as your US Tax Identification Number (TIN).

2) “…UITF fund account ….”: An UITF meets the definition of “financial account” for the purposes of FATCA (and FBAR) reporting.

3) “… banks in the Philippines.”: A bank in the Philippines meets the definition of “foreign financial institution” for the purposes of FATCA ( and FBAR ) reporting.

4) “… choose … IRS will find out?”: The Treasury Department and the IRS both learn about a taxpayer’s foreign financial account from the foreign financial institution in which the account resides. Failure of the foreign financial institution to report the tax identification number of a US Person owning a foreign account, and some details about the account itself, will result in that financial institution being held liable for breaking the PH-US agreement regarding FATCA, and would require the financial institution to withhold 30% of income generated by the accounts of all US Person-owned accounts held by the financial institution.

5) “… below threshold ….”: Account balances are not a determining factor for FATCA reporting, but are for FBAR reporting.

6) “… this sounds risky ….”: YES, it is most risky with probabilities not being in your favor.

SUMMARIZING: For FATCA reporting purposes, financial institutions in the Philippines are bound by a PH-US Agreement to provide the US IRS with certain information about accounts held by US citizens and US Resident Aliens (aka US Persons). Failure to do so results in harsh economic penalties that financial institutions will do anything to avoid.

Chances are 100% that the bank will ask you, when you are opening your UITF account, to provide them with your US tax identification number by completing and giving them a Form W-9. Refusal to provide the completed form will most likely result in not being able to open the account.

“Hiding your ownership of a foreign financial account” is truly a :no win situation

Hi Morph — As I often say, “When it comes to ‘tax questions,’ there are no simple answers.” Once again, that statement rings true. To provide you with a complete answer, I’ll need to break your question into parts, answer each part, then knit all of the answers together into the simplest, easiest to read and understand reply.

1) “…a US resident….”: Are you subject to reporting requirements under FATCA and/or any other government programs?

—- If you are a US resident – meaning that you possess a valid immigrant visa (aka “Green Card”) – you are liable for filing US income tax returns and paying any related income tax. using your Social Security number as your US Tax Identification Number (TIN).

2) “…UITF fund account ….”: An UITF meets the definition of “financial account” for the purposes of FATCA (and FBAR) reporting.

3) “… banks in the Philippines.”: A bank in the Philippines meets the definition of “foreign financial institution” for the purposes of FATCA ( and FBAR ) reporting.

4) “… choose … IRS will find out?”: The Treasury Department and the IRS both learn about a taxpayer’s foreign financial account from the foreign financial institution in which the account resides. Failure of the foreign financial institution to report the tax identification number of a US Person owning a foreign account, and some details about the account itself, will result in that financial institution being held liable for breaking the PH-US agreement regarding FATCA, and would require the financial institution to withhold 30% of income generated by the accounts of all US Person-owned accounts held by the financial institution.

5) “… below threshold ….”: Account balances are not a determining factor for FATCA reporting, but are for FBAR reporting.

6) “… this sounds risky ….”: YES, it is most risky with probabilities not being in your favor.

SUMMARIZING: For FATCA reporting purposes, financial institutions in the Philippines are bound by a PH-US Agreement to provide the US IRS with certain information about accounts held by US citizens and US Resident Aliens (aka US Persons). Failure to do so results in harsh economic penalties that financial institutions will do anything to avoid.

Chances are 100% that the bank will ask you, when you are opening your UITF account, to provide them with your US tax identification number by completing and giving them a Form W-9. Refusal to provide the completed form will most likely result in not being able to open the account.

“Hiding your ownership of a foreign financial account” is truly a “no win situation.”

I wholeheartedly recommend that you provide your tax identification number to the bank when you apply to open that account, and don’t tempt fate. As mentioned in the article, FATCA is more of a “bank – IRS” rather than a “taxpayer – IRS” arrangement . Compliance with FATCA is an easy, “non-event” for taxpayers.

Hi Paul:

I have a brokerage account here in the Philippines, I’m a greencard holder. One time, they ask me too if I’m a US Person. Let’s say my initial equity is Php 100,000. After 10 years of investing in the Philippine Stock Market, I received dividends and sell my stocks to cash out. Will that be taxed too? Let’s say after 10 years, I have Php 1,000,000 total equity after I sold my stocks, how much(approximate) of those should go to the US government? Will the IRS require the bank to wire the tax? Or should I be the one sending the tax money to IRS? Thanks!

Hi Matt – Let’s go through this “by the numbers” ?

You are a “green card holder” – an informal term for a “U.S. Resident Alien” – and more likely than not, you have a U.S. Social Security Administration Number (SSAN).

Similar to a “U.S. Citizen,” a “U.S. Resident Alien” is considered to be a “U.S. Person” for matters related to the U.S. Treasury and the IRS; and, like the “U.S. Citizen,” the SSAN is considered to be that person’s U.S. Taxpayer Identification Number (TIN). So, I am sure that told your broker that, “YES!” you are a “U.S. Person.”

For U.S. Income Tax purposes, a “U.S. Person” is considered to be a “U.S. Taxpayer” and is subject to the reporting of all income he/she received during the entire “tax year” from each and every source it was received, worldwide; and paying U.S. Income Tax on any and all of that income, provided that it is not “exempt from U.S. taxation” or subject to its exclusion from being included in the taxpayer’s “gross income.”

Lot of technical talk – with each word having its own significance – that boils down to “you’re going to pay U.S. Income Tax.”

It also means that you are required to report the existence of your foreign (i.e., Non-U.S) financial assets if:

— the aggregate (totaled) value of those assets exceeded a specific threshold amount for reporting; and

— you personally meet specific qualifications that require you to report those assets.

Again, very technical, but meaning that generally, if you have a high net worth (as determined by the U.S. Treasury and/or IRS) you’ll be required to make those annual reports – something that lower net worth taxpayers do not have to do.

Now, on to your comments and questions regarding your shareholdings.

1) In each “tax year” that you received dividends from your stock shares, you are required to report your receipt of those dividends as “unearned” income on your U.S. Individual Income Tax Return (generally, Form 1040) and pay the associated U.S. Income Tax, based on the tax rate specified for dividends.

In short: you’re required to pay U.S. Income Tax on those dividends.

2) In the “tax year” that you sell those shares of stock, realizing either a “gain” or a “loss” as a result of the sale, you are required to report the details of the sale on your tax return and, if you realized a “gain,” pay U.S. Income Tax on that gain, based on the “capital gains” tax rate that is specified for your income level.

In short: you’re required to pay U.S. capital gains tax on any gains (or profits, if you will) that result from the sale of your shares of stock.

3) Computing the tax on the gains resulting from that sale is rather straightforward.

— The amount you receive for the shares you sell is referred to as the “proceeds” of the sale. Let’s assume that the proceeds would be PhP 1,000,000.

— The amount of “equity” – better stated as your “adjusted tax basis” – that you have invested in those shares you are selling, equals the amount you paid for those shares when you originally purchased them, as adjusted, if need be, for different situations that might have occurred during your ownership of those shares (e.g., adjusting your tax basis due to a “stock split” or receipt of “qualified dividends.”) Let’s assume that your adjusted tax basis for these shares is PhP 100,000.

— Computation of your tax gain(loss) is simply the subtracting of your “adjusted tax basis” from the “proceeds” of the sale; or:

PhP 1,000,0000 – PhP 100,000 = PhP 900,000 (tax gain).

If there were any “expenses of the sale,” such as a fee charged by your broker to transact the sale on your behalf “at the marketplace,” those expenses would “adjust” your tax basis. Let’s assume that your broker assessed a “1% of proceeds transaction fee” as “his payment” for performing the sale for you. That would make his fee PhP 100,000 and, after adjusting your tax basis for the fees, your new “adjusted tax basis ” for those shares would be PhP 200,000 (original 100k + the 100k of fees).

The computation of your tax gain(loss) is now:

PhP 1,000,000 – PhP 200,000 = PhP 800,000 (tax gain).

4) Other factors will determine the “nature” of this tax gain.

— Because you sold shares of stock (which are considered as “capital assets”) the resulting tax gain would be a “capital gain.”

— Because you held ownership of those shares of stock for longer than one year, the tax gain would be considered as “long-term.”

— Together, your gain on the sale of those shares is considered to be a “Long-Term Capital Gain” (LTCG) – which is subject to more favorable tax rates than those applied to “ordinary gains.”

5) Depending on your income levels, the capital gains tax rate that could be applied to your LTCG might be 5%. So, in our example, your capital gains tax on the sale of your shares of stock would be:

PhP 800,000 x 5% = PhP 40,000.

6) This capital gains tax will be added to your “ordinary” tax to determine the total amount that you will owe the IRS when you file your income tax return.

7) Generally, foreign (non-U.S.) financial institutions are not required to withhold U.S. income taxes on behalf of “U.S. Persons” unless the U.S. Person requests withholding, or the IRS requires the withholding occur for reason(s) known to them. This is not to say that your broker won’t withhold U.S. Income Taxes if he thinks that doing so is the safest thing for him to do.

If your broker decides to withhold U.S. Income Taxes on your behalf, then it is up to the broker to choose the method of remittance that is agreeable to the IRS. In this case, you are “out of the picture” as the responsibility for remitting withheld U.S. Income Taxes rests on the broker – that is why he is paid his fees: to carry out his “fiduciary” duties as a broker.

Of course, this doesn’t relieve you of your responsibility to make sure that your taxes are paid.

SUMMARIZING:

— You are liable for reporting and paying taxes every year.

— As a “U.S. Person,” your broker is not required to withhold U.S. Income Tax from moneys they provide you (interest, dividends, gains, etc.) so long as you:

a) have identified yourself as a U.S. Person to your broker; and

b) provided him with your Taxpayer Identification Number and any other information he needs to make his required reporting of financial income, assets, and transactions involving your account.

— You hold the ultimate responsibility for all aspects of your U.S. Income Tax situation; even though others may have their own responsibilities placed on them.

As an apology for the length of this response, I can only repeat what I’ve said in the past: “When it comes to taxes, there are no simple, cookie-cutter, one-size-fits-all answes; and certainly no simple answers at all. “

Thank you so much Matt! I Php 40k is small compared to what I was expecting in the beginning. Appreciated your explanation.

Does the same computation also hold for mutual funds (same amount)invested in the Philippines? I’m planning to buy mutual funds too soon.

Hi Matt – Yes, it does.

In this unique instance of a short and sweet answer, you can substitute “mutual fund units” for “shares of stock.”

Be advised, however, that purchasing and owning “foreign registered funds” (non-U.S. registered funds) brings with it additional reporting requirements for U.S. Treasury and IRS purposes.

Hi Paul,

My friend who has a number of existing financial accounts like Mutual Funds, UITFs and shares of stocks, have an application to the US with her wife, and I think they will be migrating in the US soon. My question is do they need to sign again a FATCA form for each of their financial accounts? Are they still obliged to report this to the IRS?

Thanks!

Hi Bob – Your friend should only need to provide the financial institutions holding those existing financial accounts with updated personal data, such as address and phone number.

(There are no specific “FATCA forms” that individuals sign and file. You may be referring to the forms that are used to provide a taxpayer’s tax identification number to entities involved in financial transactions with the taxpayer.)

As for annual reporting (filing an FBAR with the U.S. Treasury Department, not the IRS), your friend would be required to continue the reporting of his/her foreign financial accounts so long as they remain within foreign financial institutions and their aggregate value exceeds the USD $10,000 reporting threshold at anytime during the calendar year being reported.

Note: Individual shares of stock that are held by an individual are not included in an FBAR. Brokerage accounts that may be holding those shares for the individual, however, are included.

Hi Paul,

I have opened a UITF in a bank in the Philippines three years ago(this is a 5 years payment thru the bank)

I am currenlty working here in Singapore. Im gonna be migrating and will be working in the US next month. What would be your advise for me because during the time I opened the said UITF, I was still not a US person , so with regards to FATCA, let’s say 10 years from now I will withdraw/redeem my money in the bank, how much will the bank tax for IRS?

Thanks

Kim

Hi Kim – When you “migrate to the U.S.,” I assume that you will be obtaining a resident visa (“Green Card”) and will apply for a U.S. Social Security Account Number.

During any year (or part of a year) in which you are a U.S. Person, you will be liable for reporting the existence of the Unit Investment Trust Fund (UITF), its maximum value during the year, and report any taxable interest or dividend income generated by the UITF if the maximum aggregate value of all of your foreign financial accounts exceeds certain threshold amounts.

For income tax reporting purposes, a U.S. Person residing within the U.S. and filing an income tax return using the filing status of “Single” or “Married Filing Separately” would have the filing threshold of the total value of all specified financial assets exceeding $50,000 on the last day of the tax year or exceeding $75,000 at any time during the tax year. The reporting of all specified financial assets is performed on Form 8938 which is included in your U.S. income tax return. Any interest or dividends income generated by the UITF will have to be reported on your U.S. tax return and income tax will be assessed against it. If you pay Philippine income tax on that interest or dividend income, you can claim a Foreign Tax Credit that will reduce your U.S. income tax on a dollar-for-dollar basis equal to the tax you paid to the Philippine BIR (this eliminated double-taxation on the same income).

Outside of income taxes, there is the Report of Foreign Bank and Financial Accounts (FBAR) that must be filed annually if the filing threshold is exceeded. This threshold is a maximum aggregate value of all foreign financial accounts exceeding $10,000 at any time during a calendar year.

As your UITF is most likely denominated in Philippine Pesos, the maximum value achieved during the year would have to be translated into U.S. Dollars, using the U.S. Treasury Fiscal Service Exchange Rate for December 31 of the year being reported. (For December 31, 2015, the exchange rate was PhP 46.8360 = USD 1.00.)

I’ve only touched on your question as there are really no simple answers – answers can follow different paths based on differing circumstances. I hope what I’ve provided helps.

Hi Paul,

Thank you so much for taking some time to read my query and for the very detailed explanation .

It helped a lot. More power to you. Godbless.

Kim