YEOW! It’s been a month since the last article – how did that happen? Mea maxima culpa! DOUBLE YEOW! – That last article stirred up a hornets’ nest’s worth of inquiries, discussions, and other voracious animals intent on consuming all of my spare time. It also led to acquiring some new, paying clients. I’ll mimic […]

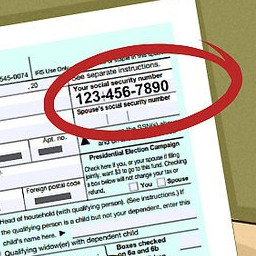

Tax ID Number?

The time for gathering personal information needed to file a U.S. income tax return is at hand. Those of you who have been down this road before and have filed U.S. income tax returns in the past know the routine. For some others, however, this could be a new – and possibly overwhelming – challenge. […]

THE IRS NOTICE

It’s that time of year, taxpayers. The administrative computers at the Internal Revenue Service are automatically cranking out and mailing tens of thousands of notices this summer. If you are one of the “lucky recipients” of this form of correspondence, then please read on. If you’ve managed to “dodge the bullet,” you may want to […]

F A T C A + U

The questions keep rolling in. After a little research to ensure current information, the answers roll right back out. With many clients sending their tax information to me early this year, things are starting to get pretty busy. Time for researching is at a premium, so when help comes along from the IRS, it’s welcome. […]

ACA sez, “12MO MEC”

What the “padiddley” is that? Off the medications again, Paul? You’re writing gobbledygook – what are you trying to say? Well, dear readers, that’s shorthand for our topic today. Many a question has been asked regarding this topic, so I guess it’s time to remove the mirrors and clear the smoke. Here’s the key to […]

January 19, 2016 …

… has come and passed. A new phase has just begun, and the length of its “season” is entirely up to each, individual person involved. Are you involved? Maybe; maybe not. Let’s find out. The somewhat magical day cited in the title is the day that the U.S. Internal Revenue Service started accepting electronically filed […]