This article is kind of a follow-on to the piece I wrote recently here called Decide by Facts which was mainly suggesting near-heresy in some people’s minds, simply by pointing out the the popular Philippine Permanent Visa 13 series, for the family of Philippine/former Philippine citizens, was NOT the ONLY answer for living full-time in the Philippines.

And even when it is, long-term, the best option, there is no need to go through the hoops of getting that visa before you make the move to the Philippines and even find out if you are really going to be able to stand living here.

It’s like placing artificial stumbling blocks in your way just to make your move even harder.

Today I’d like to talk sense about another very important program for foreigners wanting to live in the Philippines, permanently (as in for life, or as long as they desire), called the SRRV (Special Resident Retirement Visa).

Some of you already have your cursor poised over the “Back” or “Next” button, because you already “know” about the SRRV and you aren’t prepared to hear any more for one simple reason …

EVERYBODY KNOWS the SRRV is Expensive!

Maybe it is the “expensive option”. And, then again, maybe it’s not.

If you are bound and determined to skip over this subject, no problem, it’s your prerogative, but you might want to invest a few minutes in reading and even ‘fact checking” what I’m going to say here … just in case.

I could have chosen the title of this article based around almost any number of subjects.

Whenever I try to answer people’s questions or offer advice about living in the the Philippines, I invariably hear, from the vey beginning, comments and even arguments from people who know the cost of everything.

And, almost invariably, the cost is always “Too High” and therefore they don’t even want to listen any further, because their minds are made up and any “thinking person” would be insane to chose any options which cost money (or appears to cost money, at any rate).

Rule One: Always Go With The Cheapest.

Good advice? Well maybe, sometimes. But it is in my opinion a bad rule to follow slavishly without considering value received as well.

People are really, really, really good at knowing what things cost.

But, many times, they are not nearly so good at figuring out the value of things.

Price vs. Value

Price vs. Value

For a quick example, how many of you who live in the USA have one of these in your driveway? (I know it won’t be in your garage, because your garage is full of tons of “stuff” you bought, are paying for credit, and have no where else to put)?

Are you kidding me? I’ll venture a guess of “not many”. A tiny little three-cylinder roller skate of a car that’s more like a skate board than an automobile? No way, man.

Never mind that it is sold as a good old American brand, Chevrolet, that it’s the cheapest list price of any car sold in America, that’ it’s price hasn’t increased in more than two model years, that it has possibly more airbags than any other car sold in America … the list can go on … in automotive quality and feature terms is definitely a well made little car.

But I doubt there’s many readers here who are lusting for one of these in their garage.

Me neither.

If I were to move back to the USA, this is NOT a car that’s high on my list of possible purchases.

But after all, it is a car, an American branded car, pretty well made. all required features, and it does basically what every other 4 wheeled vehicle does.

Isn’t price the deciding factor, after all?

Hmmm. Maybe Always Choosing the Cheapest Is NOT the Way To Go?

The overwhelmingly pervasive message you will get from this site and many others about living in the Philippines is that the 13 series Permanent Visa is the only viable way to live in the Philippines full-time.

For those of you already married (successfully married) that is to Filipino or former Filipino citizens, then this view may indeed be be correct. (as long as you didn’t marry just to get a visa … wow I could write a book on that … maybe I’ll title it, “The Most Expensive Visa You’ll Ever Own” or something like that. But that’s a (horror) story for another day).

But What about:

- Those of you NOT married to a Filipino/ former Filipino?

- Those of you married to a partner with other than Filipino citizenship/birthrights?

- Those of you who have “His, Hers and Our” children … children of, say a first wife who wasn’t Filipino can’t be included in a 13-series visa)?

- Those of you happily NOT married who don’t feel the need to “run with the herd” and get married to someone you hardly know and then spend the next 10 years moaning and bitching about her money-grubbing relatives?

- Those of you happily partnered with same-sex companions?

- Those who don’t want to be bothered with the Annual Reporting hassles, with needing an ECC and paying extra travel taxes just because they are on a permanent visa.

- Those of you who unlike a majority of Americans actually have some savings and want to put them to work in retirement?

- And quite a few others …

In short, we are all humans and we don’t all fit into the same “shoe box”, even if many in the “move to the Philippines” community seem to think we should,

The SRRV Is An Answer, But It Does Cost Something

But if you look at the facts (not the scuttlebutt) and the value received, it may, in fact, turn out to be a very good value.

First of all, I re commend you learn just what an SRRV does cost, instead of relying on all the wild and often inaccurate prices I have seen flying around the Internet over the years.

All SRRV Visas Are Not Alike

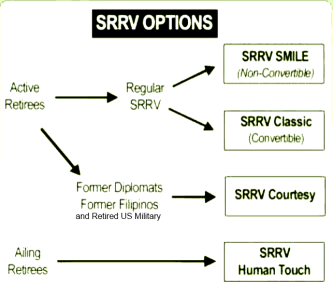

There are four basic flavors or “Options” in the SRRV family. This graphic tries to simplify how the options break down and which retirees they might be suitable for.

First of all, let me make a comment about cost and value regarding the SRRV program in general which makes it very unique … and a tip that will save you money.

Over the years I have heard of a number of folks who have paid for help in getting a Thirteen series visa or an SRRV.

From what I have been told, folks have often paid fees of up to $1000 USD or even more. I would say there is really no need to pay for “help” with either visa, but then again, you technically don’t “need” to pay for help with your income taxes, either .. yet most of us do.

If you choose the BI 13-series visa, you’re on your own. The BI will do their job and process your application when it is all correct, but if you can’t figure out how to get all your “ducks in s row” for the visa, nobody else cares.

You Don’t Pay For Help With the SRRV

Unlike the confusing and sometimes even conflicting choices one is faced with by the options for the 13 Series visas, getting an SRRV is much, much simpler … mainly because an agency of the Philippines actually cares if you get you SRRV or not. That is the PRA (Philippine Retirement Authority), whose job in life if to connect foreigners who want to live in the Philippines with a visa.

I’ve heard about people paying a thousand dollars or even more for “help” in getting a 13 series visa. One should not have to do such a thing, but given the unclear instructions and many choices an applicant is face with, I can understand why people chose to do this.

But you should never, ever have to pay for help with the SRRV, because the SRRV are marketed by accredited marketers licensed (and PAID) by the PRA (Philippine Retirement Authority).

Here’s an example of one such person, there are many others (courtesy of my friend Bob Hammerslag who maintains another excellent blog on living in the Philippines, My Philippine Life:

Maria Rose Baranda is a myphilippinelife.com reader and is accredited by the Philippine Retirement Authority to assist those of any nationality desiring to obtain a Philippine SRRV retirement visa. She will personally handle your application from start to finish. … Maria Rose promises prompt personal attention, no bribes and no dodgy-backdoor dealings. If interested, email us at [email protected]. We will forward your request to Maria Rose. Please download the assistance form below and then print it out, and email it to the above email address. If you need help with the form, let us know. Click this link for the form: Assistance_Request_SRRV.pdf

Three Types of SRRV I Want To Discuss (Just so you Know):

This is the “bottom line” visa with the least flexibility and the highest “Non-Convertible” investment requirement. The non-convertible aspect requires that you make an upfront investment of $20,000 USD and that money is locked in to a PRA approved (interest paying) bank for so long as you remain in the SRRV program.

Time and time again I hear people ranting and raving about the fact that “the Philippines” is making you “Buy” a visa.

Actually nothing could be farther from the truth, but it must be my old age showing, perhaps.

Many years ago, when I was a boy (and dirt had just been invented), it was considered prudent and wise o have saving in the bank. Today, the USA has the lowest savings rate of any developed country, and apparently (especially listening to the “chowder heads” who call into Suze Orman’s show)(these are really Americans who went to school in the USA? … God help us all) … having money in savings is virtually a sin..

Putting $20,000 USD in the bank is hardly the same as “buying” something for $20,000. The money is still yours and you can get it back at any time you want to leave the SRRV program and either leave the Philippine or revert back to another visa. As just one example (and we all hope it never comes true for us .. but .. suppose you are living happily here in the Philippines on your SRRV “Smile” visa with your required investment in the bank and you suddenly get struck down with cancer. You decide you are going to go back to the USA and put yourself under the “tender care” (or at the mercy ) of US Medicare.

Well, sorry to see you go, but having $20,000 in your pocket will certainly help in the transition, wouldn’t it.

We used to tell people “save for a rainy day”, and a major illness is definitely a rainy day.

The SRRV “Classic”

This visa requires a larger deposit for younger applicants, but it features the all important aspect of flexibility. Once the deposit is in the bank and your visa issued for 30 days, you have the option of requesting the money be released for an approved investment.

What’s is an “Approved Investment”? Well, among other things you can purchase a condo unit. This is very easy to do in the Philippines, especially with a $20,000 or more down payment.

And, no, there is no requirement that you yourself LIVE in that condo unit. You can purchase a unit and just let the real estate developer rent it out for you. There are thousands of people availing of this sort of deal in Manila and other large cites, and if you follow the “Golden Rule” of real estate (Location, location, location) it should be easy to rent it for more than the required mortgage amortization. Plus, all income tax advantages of owning rental property come into play … it’s worth considering.

Another “Approved Investment” you can opt for is the lease of land and a home. Foreigners can’t “own” real property in the Philippines, but they can legal lease real estate easily for 25 years with an option for another 25 years. Something many people don’t seem to consider when they move here, and think about the “cost” of an SRRV is, you have to live somewhere, don’t you? It might be a very smart thing to make one SRRV deposit serve the purpose of getting you a life time visa _AND a place, of your choosing, to live.

The SRRV “Courtesy”

Many of our readers here, like me, are retired from the US (or other Philippines allied nations). If they aren’t married to a Filipina/former Filipina, this visa is very, very attractive. As long as they are receiving a military retirement pension, the required deposit is only $1500 USD. The details of this program are not yet on the PRA SRRV site, but I can assure you this program is alive and well.

I mean what advice will most financial advisors give you when you ask them what to do with $20,000 to $50,000 USD that’s “idling” in the bank at today’s low interest rates?

Invest it, they are going to say, and a prime investment recommendation is always going to be real estate … especially if you don’t already have a roof over your head.

But, whatever, I want you to consider something absolutely astounding about these programs …

All Of Them Start at Only 35 Years of Age!

Just stop and think about that for a moment. Free at 35 years of age! And think for a moment also about the word and more importantly the basic concept of FREEDOM.

The vast majority of my readers here are Americans and a large percentage are also from other, highly developed “Westernized” countries like Canada, the UK, Germany,the Scandinavian counties, Australia, New Zealand, et al.

All those countries are known world-wide as countries where freedom is both prized and practiced. Yet how free, really, is a citizen of any of those countries when the norm, and even the law in many cases, requires you to work at a J*O*B, often herded into a cubicle like cows in a barn or brood pig whose feet never touch the ground … existing only to produce the next litter of babies to “feed the system” and then be impregnated artificially (bend over and submit, it won’t hurt at all) and made to complete the cycle over and over again until you reach a certain age.

I know it’s not good for me for a couple of reasons: 1) I bought one of Bob Martin’s books that talks about visas, secondly, in MY case, he told me it wasn’t good for me, but again – that’s for MY personal situation. I’m going with the Tourist Visa. Thanks Bob for always helping out. I’m going to read Dave’s post because “Knowledge is Power”.

Thanks, Bill. You are welcome for whatever little bit of help I was able to offer. 🙂

You caught me in the middle of reading Dave’s article. However, Bob there you go again! Who does that sound like? “There you go again”! President Regan used to say that all the time. haha Anyway, keeping with the theme – you are always modest. You have been a ton of help big time from the start. Thank you! Now back to the article I go like a good little reader. haha

I thought it was 10 grand in the bank, but no matter. Perhaps I missed the point there. Either way, a well written piece, but I’m going a different route.

There are 4 different SRRV visas, each of them have different requirements and investment amounts.

That explains it. Thanks! I’m just going with a tourist visa and visiting area countries. Be a good vacation. haha

Good info. Thanks. I was in Phil Health the other day and I noticed foreigners with a valid residency visa can also get Phil Health.

Thanks for contributing, Daniel.

Yes indeed Phil Health covers foreigners who are not married to Philippine citizens. Very few seem to be aware of that fact.

Bob just wrote an excellent report on PhilHealth a few weeks ago after his recent hospitalization.

http://liveinthephilippines.com/medical-costs-philhealth/

I am always amazed at the number of my American friends who seem to agonize over the question of the “worth” of PhilHealth. It’s worth it people, really. Trust me on that,

Hello..very informative and thank you for the info.

I have a question?..I have been at this site and is this still valid?..it is listed as a 2011 posting.

http://www.pra.gov.ph/main/srrv_program?page=1

And as a 62 year old without the required investable resources..are there any ways around something other than a tourist visa for me?..

1) not married to a filipina

2) income of about 1500 usd/monthly

3) probably 4-6K usd upon arrival

4) pretty low expectations of USA “creature comforts”..:)

I will do the tourist visa if I have to. I just would like to know if there are better options for me..:)

Thank you for the article.

~~Richard

Hello Richard,

Thanks for contributing. The information in the page you referenced above is still valid, it’s the latest page with that information on the PRA’s website.

There are a number of modifications to the SRRV “Courtesy” visa that have not been published on the SRRV website, which is why I wrote the article.

If you can not come up with the required deposit then there is no choice I know of except the Tourist Visa. You proposed amounts are doable, but TIGHT. Your major area of concern should be medical care. You can live easily on the amounts you mentioned UNLESS you get sick. Then? Not so much.

Facts of life are, in order to live long-term on the Tourist visa your expenses are going to average between $2 and $3 a day to keep renewing your visa, make visa runs outside the Philippines, etc. PLUS rent (you have to live somewhere). The advantage with the SRRV is the daily costs are less than $1 and if you apply the requires deposit to a lease, the visa deposit pays for your rent. It’s a case of money up front definitely paying off in the future … but if you don’t have it then, well, you don’t have it.

My personal suggestion is, make more money between now and then in order to have a better “cushion” against emergencies. We in America seem to have taught people in “our” generation (I’m 68 myself) that we are all washed up and can’t earn or contribute, but I assure you that you can, if you think highly enough of yourself. Best of luck and Godspeed.

Doggone it Dave! another article to set my head to spinning. I had figured on the 13 series as my best bet, but I haven’t pulled the trigger yet. Now I’m not so sure. One of these options is something my wife and I have discussed doing anyway. that is putting a substantial amount into a savings account and tapping the interest annually. If we’re doing that anyway, maybe we should also use it to fulfill a visa requirement. I’ll have to age a bit more in order to get my hands on the money without a big tax hit. But a balik bayan visa may do the trick until then. One thing I hadn’t counted on with the 13 series is the exit tax. I don’t know how often I’ll leave the RP, but I intend to come and go from time to time. I gather the SRRV does not have that requirement?

Take care,

Pete

By the way, I received your thought provoking e-mail. I’m not sure you got my (several) replies?

Hi Pete,

Thanks for another thoughtful contribution.

Points to consider:

When I mentioned having the requires SRRV in the bank as a “rainy Day” fund, notice I didn’t mention interest. The rates here are so abysmally tiny (and you’ll pay a mandatory 20% tax to the Philippine BIR on all interest anyway), that the interest on the required SRRV deposits are not worth figuring in my view. You’ll earn enough to pay the BIR and pay the $360 a year visa fee and not much more.

On the travel tax, a great many readers here are only interested in coming to the Philippines and _NOT_ traveling, so the Travel Tax differences are not worth much consideration either. Everyone, on nay sort of visa pays travel tax after a one year stay in the Philippines. But with a 13-series Permanent Visa, you will pay any time you travel, regardless of how long you stay. So it only makes a deferment if your travel is going to average out at more than once a year or so.

Pete,

A thousand pardons for being tardy. I am indeed working on a good reply to the cattle emails. I’m so far behind I wake up in the morning thinking I’m ahead .. until reality sets in. (Don’t as Bob how far behind I am on my articles here with LiP … it’s embarrassing *sigh*. Wish I had a J*O*B so I’d have time to catch up …

Hi Dave – I am not sure which retirement visa we got an application for but my wife is Australian 37, I am Australian 34, My son is 5 and my daughter is 4. My wife as primary applicant can cover us all. The cash works out to circa $2500 for everything + investment amounts. $2500 for the family isn’t so bad.

Hi Dave – It is a (Form PRA-RRSC-2013-01) Funny that I am to young to retire. It’s handy to get an older wife sometimes. Lol.

Hi Brenton,

If the form is a PRA form that means you’re getting an SRRV. At the price you mentioned it has to be an SRRV “Courtesy” visa for Former Filipinos.

As you say, it is certainly not a bad deal _at_all_. You are smart to think of value received not just basic purchase price.

For those who aren’t all that familiar with investment-required visas, to live in the USA, for example, you’d have to buy into a business at more than $2,000,000 USD (if you were even eligible). And Australia has a “Visa For Investment type” program. To live in a metro area the required investment is in the area of $600,000 USD. This can be reduced to the range of $400,000 USD if you are willing to locate in certain, defined, “Outback” areas.

So things certainly do cost less in the Philippines.

Hi Dave – They are big figures for America/Australia. I was just provided the form by a friend that is friends with a senior member of the department in Manila. We aren’t former Filipinos though. I thought the price out of pocket was reasonable though.

Brenton,

Well if you are getting the visa through the PRA for the price you mentioned, you must be getting some form of the “Courtesy” visa. Best of luck and when are (and where) are you actually making the move?

Hi Dave – We live in Dumaguete now and have been here 2 years. We will do it in next 6 to 9 months. I wasn’t aware it was possibly a price favor. I just have a good friend that has a good friend. I thought that I was getting standard pricing.

When Dave mentioned a “Courtesy” visa, he did not mean you were getting a price favor.. that is the name of one of the Visas under the SRRV program. 🙂

Hi Bob – I wasn’t aware of that! Cheers.

As I recall there is a 10K USD and a 20K USD SRRV visa. With the 10K USD plan you must have your retirement money ( Social Security, Pension or other such regular payments ) direct deposited into your SRRV approved account. You CAN withdraw those monthly direct deposits to use as you wish.

With the 20K USD SRRV you do not have to have your monthly Social Security or other retirement regular payments direct deposited into your SRRV account.

A suggestion worth considering, if you qualify for either of these visas and you can not afford even the 10K USD SRRV, do you think you really have enough money to move to and reside in The Philippines ? That deserves some serious consideration.

I believe but am not sure, I think you may also be able to be employed at least to some extent and there are also other benefits in having an SRRV ( if you qualify ) as opposed to staying and meeting the requirements of the tourist visa.

For me, one of the SRRV visas would be the most practical way to go. The way I see it, in the end it would be less potential headaches, you would get whatever are the most benefit of permanent residency, no obligation to keep renewing a tourist visa and paying a fee and having to make a periodic visa run to another country.

Hi Bob NY,

Thanks for contributing. As usual your comments are just full of valuable insights. Here’s a few thoughts and answers.

<blockquoteAs I recall there is a 10K USD and a 20K USD SRRV visa. With the 10K USD plan you must have your retirement money ( Social Security, Pension or other such regular payments ) direct deposited into your SRRV approved account. You CAN withdraw those monthly direct deposits to use as you wish.As the article you’re commenting on mentions there are 4 major types of “flavors” of the SRRV. Rather than repeat yet again, you (and others reading) are invited to visit:

http://www.pra.gov.ph/main/srrv_program?page=1 Each and every requirement is listed in a relatively easy to read tabular format here.

The deposit requirements vary from $0 USD up through $50,000 USD, depending on the applicant’s age and the “Flavor” of visa applied for. There is a Pension income requirement for some levels and no pension requirements for others. In NO case is there a requirement for direct deposit of a pension to you SRRV deposit account. In fact, this would be a very bad idea, because you can’t withdraw from this account without PRA approval. The language reads:

Show proof of monthly pension remitted to the Philippines (US$800.00 for single applicant and US$1,000.00 for married couples)

You do NOT have to have the pension funds direct deposited … many pension sources in the USA will not do direct deposits .. US Military and Civil Service retirements as just one example. But applicants who can show proof of funds and a banking record which shows the amounts are coming to the Philippines should have no problem,

With the 20K USD SRRV you do not have to have your monthly Social Security or other retirement regular payments direct deposited into your SRRV account.

Yes. In the SRRV “Classic” option the choice is between showing enough pension income or making a larger deposit.

<blockquoteA suggestion worth considering, if you qualify for either of these visas and you can not afford even the 10K USD SRRV, do you think you really have enough money to move to and reside in The Philippines ? That deserves some serious consideration.</blockquote

Amen to that, Bob. This one paragraph is really the heart of what I am trying to convey. Folks, you have to have realistic expectations. It seems like 90% of the questions I get are about the cost of things here, and many of the folks asking those questions make it clear they have virtually no income at all, or no income over and above a very minimal Social security or Disability income. Folks, I’m not a rich man. I don’t look down my nose at people who have less income than I. But if you can’t come up with,, say $10,000 USD and still have money left to live on? The Philippines is NOT a good goal for you now.

You can’t come here and live on “nothing”. And many whom I deal with never even consider the fact that they are living in a totally artificial environment in the USA. There are government and private charity programs galore which help- people in the USA. When you come here you get NOTHING. If you get sick, for example, you pay or you die. It’s very hard for some folks to get their head around … I know. And I am sorry because as I write these words I just know there are people out there already getting angry and just foaming at the mouth to send me an angry email. But save you bile and and anger, guys.

You want to come here with less than $10,000 USD (at a minimum) in reserve. Fine, go ahead … but remember, ITYS.

<blockquoteI believe but am not sure, I think you may also be able to be employed at least to some extent and there are also other benefits in having an SRRV ( if you qualify ) as opposed to staying and meeting the requirements of the tourist visa.</blockquote

Basically if you are on an SRRV which does not require a monthly pension, you are allowed to be employed. If you are at the level where a pension is required, then you are not eligible to be employed.

<blockquoteFor me, one of the SRRV visas would be the most practical way to go. The way I see it, in the end it would be less potential headaches, you would get whatever are the most benefit of permanent residency, no obligation to keep renewing a tourist visa and paying a fee and having to make a periodic visa run to another country</blockquote

Absolutely, Bob. You summed it up really well there. Thanks again and Godspeed.

Go along the LSVVE Visa Bill! Last 6 months and works out cheaper up to the 3 years you can keep renewing it for. I was looking at the SRRV option when I move over there in July as is far less everything to do and to put aside apart from renewing the Visa every 6 months, which is no big deal.

lots of good information here..Thanks Dave….

Hi Dave

I moved to Naval, Biliran from the USA about a year ago to be with my beautiful girlfriend. Unfortunately, 3 years ago, she married an American under the pretense that he would always take care of her.

He left her the very next day, and they have had very little email or phone contact since then. The last contact was by phone about 11 months ago, when she called him to ask a question about their “marriage.” All he said to her was to never call him again.

I would like to marry her, but obviously can’t because of this prior marriage. It seems to me that he only wanted the marriage on paper so he could take advantage of the perks associated with being married to a Filipina; in the meantime, he has nearly ruined this beautiful young lady’s life, leaving me to try to pick up the pieces…as a result, we are having many issues with trust. I am very angry. What sort of legal recourse do we have? You mentioned that this is a very expensive way to obtain a visa. I hope you can help me get a start on rectifying this horrible situation.

Thank you!

Daniel Sisk

Hello? Can ANYONE help us?!?

[email protected]

I will jump in and offer what I know. Unfortunately, the options available to you are few. All that I know of would be:

1. Convince her husband to file for divorce in the States. After that is complete she can petition to have the divorce recognized leaving her free to marry again.

2. If he is not willing to cooperate on the divorce, about all that you can do is for her to file for an annulment here. It is an expensive process and a long one.

Good luck.

Dave, I enjoyed your article also. I am getting to the party here kinda late, so you may not respond to my question.

I had looked into the SRRV over the last few weeks, and had decided for me, in the early years there at least, it would actually be the cheapest route it seemed. I figure I would save money from the travel tax, since we plan to do a lot of traveling in the beginning years at least. A couple weeks ago, Bob informed me I could change the type of visa I have there to another type, at a later date, so once I found that out, for me the decision seemed to be made, A SRRV then get a 13a later on once we dont travel too much.

It seems the Philippine govt. actually would like people to choose this type of Visa since they say they offer assistance, and some services to go along with it. I read that when arriving at the airport, that if notified before the person arrives, they will even pick the person up at the airport and take them where they will be staying for free, although I dont think I would depend on that too much, but it sounds good at least.

I read an article on LIP that Jack Emery wrote back in 2011, and was a big help.I am trying to find info on sending a container there, and what parameters are involved in that. I read that I can send one container of “household good” with a value of no more than $7000.00 free from VAT tax and customs duties. My question is who sets the value to my things, and how close to they check for the value of whats in the container. $7000.00 is really not much, if whoever puts value to the contents of the container at the current retail prices if thats what the go by. I just dont want to send all our stuff, then it gets there and customs says it worth $50,000.00 and hands me a bill for $25,000.00 in duty taxes, and hold it for ransom. We wont be sending a vehicle for sure, since they are taxed at 100% I have read. From the info I have found so far, it is all very open to interpretation, and the rules as to what can and cant be sent seem quite blurry, which could be good, or bad. As you can probably guess, I have not talked to an actual shipping company yet, just priced sending a container by Maersk online.

FOREIGN ACTIVE INCOME

Is it possible to get the SRRV (Smile) and continue to work self-employed online as I currently do in Europe (i.e. not for a local Filipino company but for example writing e-books?). Are there any restrictions on ‘retired’ foreigners earning active income from abroad into the local bank account? And is foreign earned income really tax exempt for non-citizens?

April,

Thanks for writing. The rules for a foreigner “working” while holding an SRRV in simple terms are that with one of the SRRV’s which require you to show a “retirement income” you can not work, with one of the higher priced options which do not require you to prove/direct deposit a retirement income you may work in the Philippines.

But I put “working” in quotes at the beginning of the comment for a reason.

Earning from a foreign source entrepreneurially, such as writing and selling eBooks (or conventional print books), affiliate marketing, running an off-shore membership site, etc., etc. is NOT “working in the Philippines”.

Only income earned in the Philippines is “working” in the Philippines. Foreign-sourced income is specifically not taxed by the Philippines. This is one of the great benefits of living here for foreigners.

Thank you. But I just read this (Article 3):

http://www.punongbayan-araullo.com/pnawebsite/pnahome.nsf/section_docs/IS039R_19-7-11

Which I guess means the tax law can be interpreted either way. So reading between your lines, less said the better, and let’s hope nobody sets a precedent here.

FOREIGN TRAVEL

Another question please: On the SRRV (‘Smile’ version in particular), is there a minimum time that needs to be spent in the Philippines? What stops the holder travelling away for months, or even leaving for a year or more if needs be? Do you have to physically check in every so often? And would there be penalties if you left for a few years? I’m imaging part of their ‘carrot’ is that they also want retirees to spend their daily money in the Philippines…

That is an interesting reference you furnished. I have no idea of the author’s degree of expertise but I could sit down with you and talk over paragraph three where it clearly says:

…An alien whether a resident or not of the Philippines and a foreign corporation, whether engaged or not in trade or business in the Philippines are also taxable only from sources within the Philippines…

Plus a few other points. But I am not going to. I am not an accountant nor a lawyer and all advice I furnish is my personal opinion. It is worth exactly what I charge you, which is nothing. I’ve been living in the Philippines for nearly 9 years, I have zero income from within the Philippines and non-trivial from outside the Philippines, both business income and pensions, and I don’t pay any Philippine taxes.

On your question regarding the SRRV, I have never heard of any maximum “stay away” limitations on any “flavor” of the SRRV, but again I am no expert. My suggestion for an authoritative answer is just to write or phone theRetirement Authority (http://pra.gov.ph/ ) and get the information direct from the source.

Here’s a bit of further unsolicited advice you might want to consider:

http://philfaqs.com/live-by-what-the-rule-book-doesnt-say-instead-of-what-it-does-say/

Your level of research is admirable but trying to chase every last detail before you even try living here is potentially a lot of effort down the drain. Almost everything is different to people’s expectations when they finally make the move.

You don’t need a visa in advance to come here and live on the tourist visa for some time (actually you can stay up to three years). If you like it and things are working out for you, then worry about a permanent visa. IMO, most people make the whole experience much harder than it really needs to be. Godspeed.

Sorry if I misled you Dave, I am a ‘digital nomad’ and I have actually been in the Philippines on the tourist visa 7 out of the last 9 months. But I still hold a European online company, and pay European income tax, which I am trying to avoid (not evade) by moving my residence to a low tax country and closing the company (whilst remaining self-employed). The cost of the SRRV obligations would be more than offset by my income tax savings I believe. Hence the massive research. For other business reasons (particularly the way I receive payments) Philippines is the best for me, besides being a nice place. But I still like to travel. After all, are ‘active 35 year olds’ expected to not travel the world, and not work? I read somewhere that the Smile program was very much set up to attract young Chinese and Korean entrepreneurs. I wonder how many of them are really registered for Philippine work permits, pay taxes, etc. even when they are SUPPOSED to. My guess is there’s a lot of leeway and blind eyes being turned. I get the gist of your article! But it’s still nice to sleep at night having sought advice. Can anyone else jump in? Ultimately I will hire one of those very expensive international tax advisers for a final idiot check, but only after I’ve done the legwork myself. Thanks.

Understood, and thanks for filling me in. One little technicality I see creeping in here is that our discussion leaned heavily to the income required to be reported and away from the work visa/work permit visa question. Let’s say for point of discussion that your “digital nomad” income is reportable to the Philippines BIR. That still has nothing at all to do with _working_ in the Philippines.

Since you would not be on any of the SRRV categories which require a corresponding pension, you are free to work in the Philippines using the SRRV (this can be confirmed with the PRA, you may or not required a separate work permit from the DOLE).

First I ever knew about the “Smile” SRRV being designed to capture income from young professionals. You really should consider writing on some of these issues yourself because your breadth of experience far exceeds mine. I’d be happy to host an article or two and/or I am pretty sure Bob would entertain some also.

Not only on visa or tax issues but on the general subject of supporting yourself as a “digital nomad” … so much better than the usual “open a sari-sari store” idea for supporting oneself here in the Philippines.

Best of luck in your endeavors and please update things if you find out anyhting more definitive about your foreign earned income questions.

Ok thanks I will report back. Yes I would say “capturing income” is precisely their intention, but hopefully in terms of spending money and not income tax!

From: http://myphilippinelife.com/philippines-retirement-visa-srrv/

“The Smile SRRV which requires a $20,000 deposit seems more geared to younger and more more business-oriented Chinese and Korean applicants rather than retirees”.

http://www.philembassy-seoul.com/news_details.asp?id=611

“Many Koreans are using the SRRV Smile to benefit their children interested in studying English in the Philippines for less than one year” (!)